Our latest post explores the monumental shifts shaping what could become an "American Supercycle." As Representative Thomas Massie’s “End the Fed” bill challenges the Federal Reserve’s century-long dominance, and the U.S. Treasury steps into a leadership role with Treasury Certificates and the Dividend Dollar, we could be entering a Golden Age of Wonders.

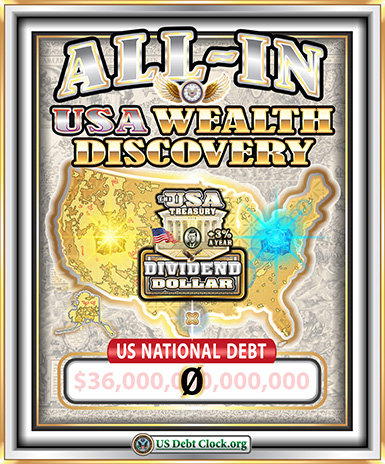

This emerging supercycle isn’t just about financial reform; it’s about reimagining prosperity. The Dividend Dollar’s annual 3% appreciation and the direct spending of debt-free Treasury Certificates set the stage for sustainable economic growth, reduced inequality, and renewed global confidence in the U.S. dollar.

Recommendation: Follow developments in Treasury Certificates and Dividend Dollars closely. Offshore investors should explore hard assets and U.S.-based opportunities likely to benefit from these changes.

Key Stories from the New Money Revolution Series

Paying Off $36 Trillion in the Jubilee Year

Starting December 24, 2024, the Jubilee Year could mark the reset of the $36 trillion national debt using Treasury Certificates. Imagine an economy freed from the chains of debt, with direct benefits reaching citizens and global markets.

Recommendation: Stay ahead by considering investments in sectors like infrastructure and green energy, which could thrive under this debt-free system.

The Dividend Dollar, appreciating at 3% annually, represents a shift to sustainable wealth. By preserving purchasing power and incentivizing savings, it offers stability in a volatile world.

Recommendation: Diversify into appreciating assets and explore opportunities tied to the U.S. Treasury’s direct spending programs.

Bitcoin, bullion, tech stocks, and Treasury yields surged as the “Trump Trade” returned to the spotlight. This mix of safe-haven assets and growth-driven investments signals a dynamic market environment.

Recommendation: Balance your portfolio with a mix of digital currencies, precious metals, and tech stocks to capitalize on this trend.

With silver making a surprising comeback, analysts are eyeing a potential return to the historical 8-to-1 gold-to-silver ratio. Industrial demand and inflation fears are fueling silver’s rally.

Recommendation: Consider silver as part of your offshore diversification strategy, particularly in the form of ETFs or bullion.

Ripple Labs is expanding its global footprint, with USD distribution powered by new exchange partners. This move reinforces Ripple’s role in cross-border payments and digital finance innovation.

Recommendation: Keep an eye on Ripple’s developments, especially as digital currencies gain traction in the offshore investment space.

Dive into the enigmatic world of global intrigue and cryptic messaging with Q: The Plan to Save the World. This groundbreaking documentary explores the mysterious origins of Q, the digital phenomenon that captivated millions.

Recommendation: For anyone curious about the impact of modern digital movements, this documentary is a must-watch.

|