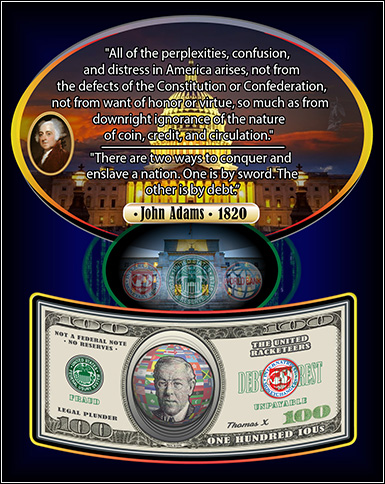

Our feature story delves into the groundbreaking transition from Federal Reserve Notes (FERN) to Treasury Certificates. As illustrated by the consistently eye-catching images from @USDebtClock_org, the U.S. is laying the foundation for a new financial system. Treasury Certificates are poised to bypass the Federal Reserve, empowering the U.S. Treasury to issue money that is spent into circulation rather than lent into

existence.

We also introduced the concept of the Dividend Dollar, which will increase in value by +3% per year, providing a stable and appreciating currency. The ramifications are enormous, potentially leading to a seismic shift in how wealth is preserved and invested. Offshore investors should pay close attention to these changes, as they will undoubtedly impact global markets and investment strategies.

Read more to understand how this new monetary framework might revolutionize the economy and your portfolio.

Featured Articles:

Ripple Announces Ripple USD Exchange Partners for Global Distribution

Ripple Labs continues to push boundaries, and this month, we cover their groundbreaking announcement of Ripple USD exchange partners. This development will enable Ripple to distribute USD globally, enhancing cross-border payment solutions and broadening the reach of digital currencies. As Ripple fortifies its network of partners, investors should watch for how these alliances may impact the digital currency landscape and open new offshore investment opportunities.

This post also explores the strategic significance of Ripple’s moves, especially in light of the SEC’s ongoing scrutiny. As the financial world adapts to new technologies, Ripple’s initiatives are a reminder of the evolving nature of global finance.

Read more

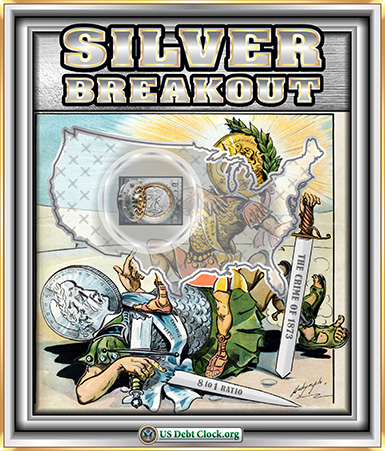

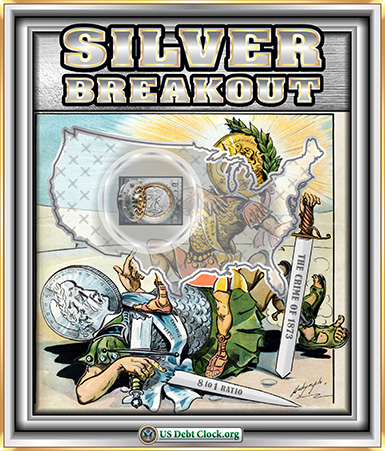

Silver Price Surges

Revisiting the “Crime of 1873” and the Return of an 8-to-1 Ratio

Silver is making waves, and our recent post takes you back to a pivotal moment in financial history: the “Crime of 1873.” This historic event demonetized silver, leading to significant economic consequences. Fast forward to today, and we’re witnessing a potential reversal. Silver’s price action suggests a resurgence, with some analysts calling for a return to the historical 8-to-1 silver-to-gold ratio.

What’s driving this renewed interest in silver? From inflation fears to increasing industrial demand, silver could be on the brink of a major comeback. Offshore investors looking for hard asset diversification will find this analysis particularly compelling. Could silver be the underdog investment of the decade?

Read more

‘Trump Trade’ Goes Turbo

Bitcoin & Bullion Hit Record Highs, Tech & TSY Yields Rise

This month also saw the resurgence of the so-called “Trump Trade” with a turbocharged effect, as highlighted in our latest post. Both Bitcoin and gold bullion hit record highs, reflecting growing investor demand for safe-haven assets amid geopolitical and economic uncertainty. At the same time, tech stocks surged, and Treasury yields spiked, indicating a complex market environment driven by shifting investor sentiment. This post explores how the renewed focus on hard assets and

digital currencies could influence offshore investment strategies in the months to come.

With the “Trump Trade” back in the spotlight, offshore investors need to be especially vigilant. The simultaneous rise of Bitcoin, gold, tech equities, and Treasury yields underscores a market grappling with mixed signals—economic optimism alongside underlying fears of volatility. Understanding these dynamics is key to navigating this environment successfully, whether by diversifying into digital currencies, hard assets like gold, or exploring new opportunities in tech and

fixed-income markets.

Read more

Looking Ahead: Key Themes to Watch

As we move forward, several critical themes are poised to shape offshore investment landscapes. Keep an eye on global interest rate fluctuations, which continue to impact emerging markets and international asset classes. The ongoing developments in gold-backed digital currencies and their implications for wealth preservation are also worth monitoring. Additionally, with retirement security becoming increasingly individualized,

expect more strategies focusing on self-directed investment opportunities. Meanwhile, geopolitical shifts—particularly in China's economic policies and the U.S. dollar's stability—could influence offshore portfolio diversification. Lastly, evolving real estate markets in sought-after regions like the Caribbean and Africa will offer both challenges and new opportunities for investors.

Stay tuned for further updates as we continue to track these pivotal developments.

|