BY DOHMEN CAPITAL RESEARCH

Nearly three months ago in early September, when the markets were in the midst of a swift selloff, analysts, money managers, and investors were asking themselves, “Could this turn into the long-awaited market plunge investors have expected all year?”

But the markets were able to quickly put an end to that plunge within four weeks and rally to new record highs in November, showing incredible resilience amid the plethora of negative factors that could have contributed to another deep decline.

Rebounds like this have conditioned traders and investors alike to consider every sharp pullback as a buying opportunity. One of these days it won’t be. We are getting close to that day.

However, on November 24th, 2021 we warned our valued members,

"Things aren’t rosy in all areas of the market as we continue to see huge down-gaps and plunges in individual stocks on a daily basis. This caused us to ask, has a bear market started?"

The following trading day (Friday, November 26th) the markets suffered their worst plunges in 10 months. Given the technical warning signals we're seeing on the charts, now is not the time to throw caution to the wind.

The cause of the market plunges on November 26 was the revelation of the new Covid variant, which late on Friday was named the “omicron” variant. It has been in Africa for some time, just not called “omicron.”

Isn’t it strange that there was no previous news about this variant? Mutations don’t appear suddenly. This is just in time for Christmas. It “coincidentally” supports all the other efforts of the panic inducers like Dr. Fauci to ruin our Christmas.

Why didn’t the markets plunge like this on previous announcements of other variants over the past year? Why now?

While the charts of the major averages may look like they've only taken a small dip amid last week's selloff, a number of big-name individual securities have been plunging since reaching their highs of 2021.

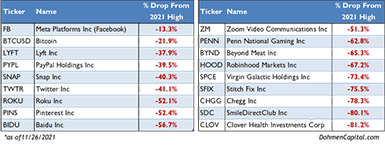

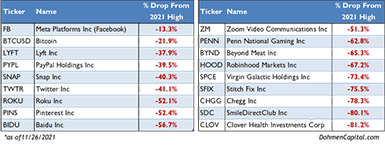

Take a look at the table below of just a handful of the "retail favorites" that have suffered huge losses. Looking at the charts of the major indices, one wouldn’t know such big plunges have occurred in so many popular securities. But investors in these have lost a fortune.

These are the types of single security corrections and bear markets that worry smart investors and have kept them in high cash positions for most of the year.

With the markets long overdue for a correction, could the latest news of the "Omicron variant" lead to a plunge similar to what we saw last year?

Having successfully navigated our valued members through the tumultuous market environment during last year's "COVID Crash," we know what clues to look for.

Some of the most important indices had shown upside breakouts to new highs a few weeks ago, which then reversed downward last week. That makes them “false breakouts.”

In our trading services (Smarter Stock Trader and Fearless ETF Trader) early last week (November 23) we noted,

“We are now seeing the first signs that maybe the breakouts to new highs of many of the major indices this month, even the very broad VALUG, were “false” breakouts. Such false breakouts often lead to very sharp moves in the opposite direction once the breakouts fail.”

Here is the updated chart of the VALUG Index below through 11/29/2021. It had a well-formed “false upside breakout” ahead of the plunge:

On Friday, November 26, we got the confirmation that the “false upside breakouts” were real.

However, with the popular major averages still trading near record highs and saw a bounce on Monday (November 29) as “bargain hunting” was the talk of analysts.

But what’s important for every serious investor to consider is that instead of bargains, you may be catching what smart, informed investors want to dump. That could actually be the start of another big bear market.

This is why in our services of the past days we revealed our best recommended investing and trading strategy that matters right now, which should allow shorter-term traders and longer-term investors to position their portfolios for an adverse market environment next year.

Ahead of the historic COVID Crash in February 2020, our clients were accurately forewarned. Then came the record fast crash of March 2020. Not only were they saved from devastating losses, but they had great opportunities to profit. With high speed computers of the HFT firms, market declines today are very fast and very deep.

Yes, you can profit when markets plunge. But you need the perceptive analysis and forecasts. And that is not easy to find.

The coming year will be extremely important for investors and traders. Getting it right will mean the difference between painful losses and big profits.

You see, the markets are no longer a function of the old metrics such as earnings, dividends, and fundamental ratios. The “official” state of the economy and rate of inflation are also totally misrepresented. The casual part-time investors don’t realize that until they have access to the best analysis.

Knowing the underlying reasons for the recent rise in the DJI 30, the S&P 500, and the NASDAQ is absolutely essential for not getting trapped when the markets have the next “surprising” plunge.

Now is the time when you need the best and most experienced research, analysis, and forecasts to help you navigate your own portfolio, safely and profitably.

To make it easy to try our award-winning investment research services, we are offering readers special Cyber Monday discounts for a limited time!

These specials are only available for the next 48 hours. This could be your big opportunity to make or save yourself great wealth through year-end and into 2022!

Click Here to Save up to $1900 on any of our Trading and Investing Services! |

About us

About us