| December 31, 2020 |

| Offshore Investment Guide |

Dear ,

Towards the final months of this year, we have seen some great news coming from the crypto space. The flagship coins of the crypto space, Bitcoin and Ethereum have made big-time news.

Bitcoin when its price went past the previous ATH and towards $30,000, and Ethereum when it successfully started its first phase towards the launch of ETH 2.0 in its transition to POS.

Bitcoin cruising past its previous ATH might prove instrumental in gaining more users for the crypto space, and the transition of the Ethereum network into POS could further decentralize the network and thus enable users with more control.

The year 2020 has literally had an impact on the life of everyone around the planet. We witnessed the whole world reducing personal interactions and consequently maintaining remote interactions. Thus, with each passing day, securing your identity and personal data has become more relevant and more important.

Self-Soverreign Identity will become the most important topic of 2021 and Invest Offshore intend to be a thought leader of this critical issue.

|

| Gold as a Store of Value and Wealth |

A store of value is the function of an asset that can be saved, retrieved and exchanged at a later time, and be predictably useful when retrieved. More generally, a store of value is anything that retains purchasing power into the future.

The most common store of value in modern times has been money, currency, or a commodity like a precious metal or financial capital. The point of any store of value is risk management due to a stable demand for the underlying asset. Money is one of the best stores of value because of its liquidity, that is, it can easily be exchanged for other goods and services. An individual's wealth is the total of all stores of value including both monetary and nonmonetary assets.

Monetary economics is the branch of economics which analyses the functions of money. Storage of value is one of the three generally accepted functions of money. The other functions are the medium of exchange, which is used as an intermediary to avoid the inconveniences of the coincidence of wants, and the unit of account, which allows the value of various goods, services, assets and liabilities to be rendered in multiples of the same unit. Money is well-suited to storing value

because of its purchasing power. It is also useful because of its durability.

Because of its function as a store of value, large quantities of money are hoarded. Money's usefulness as a store of value declines if there are significant changes in the general level of prices. So if inflation rises, purchasing power declines and a cost is placed on those holding money.

Workers who are paid in a currency which is experiencing high-inflation will prefer to spend their income quickly instead of saving it. When a currency loses its store of value, or more accurately when a currency is perceived to lose its future purchasing power, it fails to function as money. This causes people to use currencies from other countries as a substitute.

According to the Cambridge cash-balance theory, which is represented by the Cambridge equation, money's ability to store value is more important than its function as a medium of exchange. Cambridge claims that the demand for money is derived from its ability to store value. This is contrary to Fisher economists' belief that demand arises because money is needed for exchange.

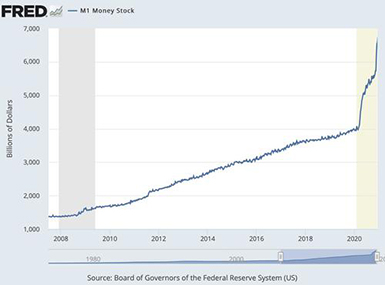

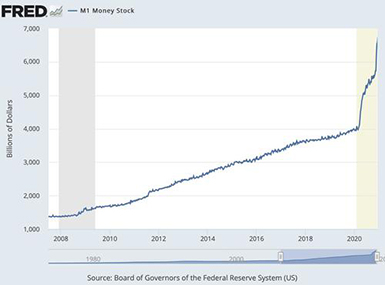

M1 money supply (the most liquid forms of cash — bills, checks and basic savings accounts) had grown faster than any time in history. I showed that using a graph like the following, which is now brought up to the most current data:

NewsMax notes that requests for property appraisals have quadrupled at one New York appraisal firm. Some of that, I would suggest, must be due to the new COVID migration. especially out of New York City. Some of it is due, according to NewsMax, to people selling investment properties in order to avoid higher capital-gains taxes down the road. The article notes that,

By late November, he had to start turning away clients. “We physically can’t handle all the year-end deadlines at this point,” Miller said. “We started doing this [turning away the overflow of clients] after the Thanksgiving holiday and it’s been extremely frustrating.”

Exactly the timing of the massive increase in the nation’s cash (M1) money supply.

The article notes that this rush into real-state sales, even after the COVID rush has surprised many advisors. Biden planned to restore a little balance to the budget by taking away this social welfare to the rich, but …

The results suggested Biden may have a difficult time fulfilling campaign promises to raise trillions of dollars in new revenue from the wealthy.

… but the rich are jumping ship in anticipation to avoid paying back some of the years of specially privileged tax cuts they almost exclusively have benefited from.

Naturally, the running of the rich is going to create some large temporary piles of cash as money moves from one kind of asset into whatever the rich are planning to do with all this money. (Maybe give it to their entitled children before estate taxes rise again — a major tax gift the aging Trump gave to his kids?)

The article also notes a big rise in the rate at which the rich are trying to sell businesses as assets as well as other investments. So, it is not just a move to sell expensive real estate … but any kind of asset on which they would see gains.

So, the rich are rushing to cash out. Though the article mentions nothing about the biggest rise in the nation’s history in supply of the most liquid forms of cash, I suspect the rush of the rich to cash out assets now has something to do with the rapid rise in cash balances. In that case, it may just be temporary, as other assets become purchased with the gains down the road.

There is reason to think some could remain in cash form. When the rich cash out, those that are charitably inclined send some of that cash to charities, especially now when tax deductions for such gifts can be applied 100% as an offset to income. That is money that often goes into operating accounts of thousands of different charitable institutions and so straight into the mainstream economy.

If it continues to be held in M1 cash form, then, being easier to spend and move down the road, it could create the kind of inflation I warned about where there is too much (cash) money chasing too few goods during a time of COVID shortages. We’ll have to remain vigilant to see. It is a matter of how the cash circulates.

Money creates price inflation where money circulates. If it stays in financial circles, there still will not be much inflation outside of financial circles; but if it goes in early gifts to rich kids, in lieu of inheritance to rich kids who profligately choose to spend it all on fancy vacations after COVID settles down and pretty toys, then it moves into the mainstream economy and can create high inflation if people start having more dollars than there are goods to buy in a time when the

recent COVID scrooge has bogged down production and transportation.

It’s time to be vigilant and BUY GOLD & SILVER. |

| Message to the People about Cryptocurrency & Offshore Banking |

10 Trusted Guarantees

1. We are Federally Licensed as a Securities Underwriter, Issuer, Brokerage, & Bank-Crypto-Stock Exchange.

2. We use AI-Bio Metrics for Verification of Your Account; so no one else can use it!

3. Our First of its Kind “Decentralized Bank” Default Page Provides all Necessary Account Functions; that You Control Privately!

4. Our Crypto Exchange Provides the following: Public Coins, BitCoin & Ethereum, Plus Free Market BitCoin 2, BitCoin BDS Dollar Stable, BitCoin Yuan, & BitCoin Won. Trade BitCoin 2, & Hodl the Profits in BitCoin BDS!

5. We also Accept Bank Wire Deposits.

6. Our “Circuit Breaker Equip Stock Exchange” Provides the Following: Foreign Exchange Market, Spot Medals, World’s Top 12 Indices, Spot Commodities, Crypto Currency Pairs with, Foreign Exchange, & Medals, Top USA Shares, Top EU Shares, Top Russian Shares, & Top Asian Shares. Up to 100 Margin, Hedging, or Netting, with Trailing Stops, You Pick what you want; it’s all about You, and Your Needs!

7. Open Your Bank as the Default Page, on Your Center Monitor, and then Launch Your Crypto Exchange on another Monitor to Your Left, then Launch Your Stock Exchange on another Monitor to Your Right. That’s Right ALL (3) AT ONCE, IN ONE ACCOUNT! “Trade anything, with anything!”

8. We Treat Your Crypto as CASH, so Your Account can be used Cross Platform right from Your Banking Page! Use Crypto to Trade the Stock Market!

9. We use only Straight Through Processing (STP) & Direct Market Access (DMA) Tier (1) for All Trading Operations. You get the Actual Best Price, not a Fake Market Low Ball price Every time.

10. We are a Government Project Underwriter, & Issuer of Securities. Our Bank has a 100% Tax Exemption for ALL INCOME Generated!

For more information about the PITBULL Exchange contact within

|

| A Pandemic of Digital Rights Abuses |

We are giving up our right to privacy, our right to gather, our right to work, our freedom of speech, our pursuit of happiness. Fear will drive us to give up just about everything in order to survive. Getting those freedoms back is a lot harder than giving them up.

The government’s role is to protect its citizens, from foreign powers, from individuals within the society itself, and from governmental abuses. It’s a balancing act to be sure. One we have watched teeter back and forth between the rights of the individual and the good of the community. Homeland security enabled the collection of private data on individuals based on the threat of terrorism. It’s hard to walk back from that policy when the threat is over—data privacy is still abused by

centralized data centers both commercial and governmental.

And now, in the midst of the COVID-19 threat, the news that Google and Apple are building APIs that allow contact tracking in order to track the spread of the pandemic so local governments can assess whether or not to impose stricter “stay at home” ordinances. This from their blog:

“Apple and Google will work to enable a broader Bluetooth-based contact tracing platform by building this functionality into the underlying platforms.”

In other words, contact tracing will be permanently built-in. To be fair, contact tracing is opt-in. And the announcement is careful to point out that privacy is paramount. But take that with a grain of salt. It was only a couple of years ago that Apple got busted for secret deals with Uber that allowed for Uber to track locations of users even when location data was turned off.

This should concern us on a couple of levels: first, we know Google and Apple already know where we are and who we are. We give them those permissions in the Terms of Service (think of it as our term of service to them). We have become dependent enough on them that we can’t live without their tech. The potential for abuse is unprecedented—not only by a company, but now as the technology is shared with the government. Difficult times require difficult decisions for sure. Our concern should be:

“Can we put this genie back in the bottle when the threat of the pandemic is over?”

Secondly: Is it within the government’s right to mandate a “stay at home” order?

Freedom is the foundation of this Country. The war for Independence was about the very personal freedoms of thought, worship, representation…not to mention the right to earn a living and the right to privacy. So when is it exactly that a government steps over the line? Here’s an example from California:

“In addition to the City Attorney’s Neighborhood Prosecutors, the Mayor announced the formation of the “Safer at Home” Business Ambassadors program — which deploys City workers and volunteers with the Mayor’s Crisis Response Team to businesses that appear to be out of compliance with the emergency order with a goal of securing voluntary compliance. If voluntary compliance is not achieved, the ambassadors will share information with the City Attorney and LAPD for follow-up. Members of the

public can report out-of-compliance businesses at coronavirus.lacity.org/reportbusinessviolation."

This feels very much like the “Brown Shirt Policies” of Nazi Germany (or MaCarthyism, or the Salem Witch Trials). Members of the public can rat out businesses they deem violators. No due process. No defense for the business owner. What’s to prevent competitors to that business trumping up accusations? Thomas Jefferson would call for a revolution against such tactics.

Next: the call for COVID-19 vaccinations to become law. This is becoming news as the fear of death spreads across newsrooms and into our living rooms. Sure we should be concerned. But everytime a law is mandated for the good of the community, rights of individuals have to be measured. In the late 1700s, in the face of Yellow Fever spiralling out of control and taking thousands of lives, John Adams signed the Quarantine Law with no opposition from Congress. It was a harsh measure in harsh

times, and did save thousands of lives at a time when the fledgling Country couldn’t afford to be decimated (War of 1812 was around the corner and the fragility of trade and establishing partners was a reality). But are we living under the same conditions now? Are we living under the same magnitude of threats when Homeland Security was formed? The President of the United States can call on the War Powers Act in times of grave threat in order to protect the majority of citizens using laws that

sacrifice individual rights so that the whole will survive. But are we at war? And is our very way of life being threatened by this pandemic?

Are my rights as an individual being sacrificed on the altar of “this is for the greater good of the whole”?

If so, the rhetoric sounds a lot like communism, where the individual is less important than the State. And pitting citizens against each other as in the California Business Ambassadors program, feels more like a pogrom.

Today, the argument over vaccinations continues. There is no law requiring vaccinations, and anti-vaxxers can opt out of school vaccination regulations. They do so at the risk of infecting others around them who are immunosuppressant, but as of yet we have no Federal law for vaccinations like measles and Hepatitis. There is an argument to be made for civil responsibility, and that’s great. But again, laws must be considered carefully. The point is, in our free society, we encourage each

citizen to be morally responsible. And we enact laws to punish the most egregious acts against fellow citizens. We don’t enact laws that allow for the oppression of one group by another.

The right to choose was measured carefully with anti-smoking laws. Cigarettes aren’t illegal, but smoking them in public is. Measure those laws against the health fact that nearly a half-million people in the US die of smoking related illness every year. They choose to smoke. Now consider stay-at-home ordinances. At what point does that mandate deny the 6 million people who have lost their jobs the right to work and earn a living? Thousands of people are dying from COVID-19. Millions are

struggling to put food on the table and pay rent. They didn’t choose to stay home. Let’s consider what is gained and what is lost very carefully when we create new laws and ordinances. Don’t those millions of unemployed people have rights? Can we measure the real impact of COVID-19 now and weigh it against the impact on the economy?

The digital age has strained our sense of freedom and responsibility.

We trust big data companies like Google and Apple to manage our data. We trust the government to access piles of personal data. We expect both to be responsible. But what if they’re not? What options do we have?

As freedoms deteriorate are we going to ask for more laws? Or are we going to rescind the ones we now recognize as leaning more totalitarian in nature?

In times of fear we are willing to give up just about everything to save ourselves, like running out of a burning building completely naked. But when the smoke settles, we deserve to get our dignity back. And our freedoms.

Keep your dignity and freedom, check out ClearID.

Best regards,

Michael Proper

Founder: ClearCompanies

|

| USA Offshore Asset Protection Structures |

South Dakota Trust Company now available

Structure a Qualified Overseas Pension Plan to be legally compliant in the United States, for tax deferred accumulation of offshore assets. Some of the most important benefits of utilizing Pension Plans are as follows:

The assets held in the Qualified Employee Retirement Income Security Act (ERISA) Plan are exempt from creditor claims (except for IRS tax liens and certain forms of spousal support).

If a creditor obtains a judgment against you and seeks to collect any assets held in your plan’s trust, they cannot do so. This includes if you were placed in bankruptcy under any Chapter of the Code, the bankruptcy judge and or trustee cannot seize assets owned by your pension plan trust.

All earnings such as rents, royalties, interest, dividends earned by the pension plan trust assets are not subject to current taxes until you draw them out of the Plan. You can withdraw funds with a 10% penalty if you are 58 years of age or younger or after the age of 59 1/2, there is no penalty but the amounts drawn down are subject to being taxed similar to the tax you would be liable for if this was paid to you as a salary. You are required to start to withdraw these funds out over the

life expectancy as the IRS table determines. Draws are required at age 72.

You can borrow up to $50,000.00 personally from the Plan but the repayment term must be amortized over 60 months at a minimum interest rate equal to the 5-year treasury bill rate (currently .22 of 1%).

One of the best uses of the Pension Plan is when you make an investment (which can be leveraged subject to certain rules) and all the capital gains are also tax deferred.

Needless to say, compounding your investment returns works really well when you don’t have taxes to pay.

It takes approximately 45 days to get both the sponsoring C Corp or LLC formed and the Pension Plan set up for use.

We also structure investments that are Plan Qualified being Capital Asset Purchases (real estate, mortgage notes vs gold coins and certain stocks and publicly traded debt instruments). Some of these investments are done in conjunction with other firms. Some clients want their Plan Assets in very safe income rental properties, first mortgage notes on rental properties and some in capital appreciation assets wherein we buy distressed bank assets, renovate them and either hold and rent them or

resell in the market.

For more information about the Structure of a Qualified Overseas Pension Plan contact within

|

|

|

About us

About us