| June 30, 2020 |

| Offshore Investment Guide |

Dear ,

Welcome to the Global Economic Reset

THESE are the times that try men's souls. The summer soldier and the sunshine patriot will, in this crisis, shrink from the service of their country; but he that stands by it now, deserves the love and thanks of man and woman. Tyranny, like hell, is not easily conquered; yet we have this consolation with us, that the harder the conflict, the more glorious the triumph. What we obtain too cheap, we esteem too lightly: it is dearness only that gives everything its value. Heaven knows

how to put a proper price upon its goods; and it would be strange indeed if so celestial an article as FREEDOM should not be highly rated. ~ Thomas Paine

|

| Coronavirus and CARES Act

|

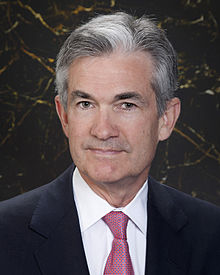

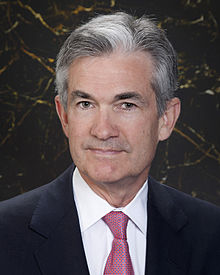

Chair Jerome H. Powell - Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C. on June 30, 2020

Chairwoman Waters, Ranking Member McHenry, and other members of the Committee, thank you for the opportunity to testify today to discuss the extraordinary challenges our nation is facing and the steps we are taking to address them.

We meet as the pandemic continues to cause tremendous hardship, taking lives and livelihoods both at home and around the world. This is a global public health crisis, and we remain grateful to our health-care professionals for delivering the most important response, and to our essential workers who help us meet our daily needs. These dedicated people put themselves at risk day after day in service to others and to our country.

Beginning in March, the virus and the forceful measures taken to control its spread induced a sharp decline in economic activity and a surge in job losses. Indicators of spending and production plummeted in April, and the decline in real gross domestic product, or GDP, in the second quarter is likely to be the largest on record. The arrival of the pandemic gave rise to tremendous strains in some essential financial markets, impairing the flow of credit in the economy and threatening an even

greater weakening of economic activity and loss of jobs.

The crisis was met by swift and forceful policy action across the government, including the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). This direct support is making a critical difference not just in helping families and businesses in a time of need, but also in limiting long-lasting damage to our economy.

As the economy reopens, incoming data are beginning to reflect a resumption of economic activity: Many businesses are opening their doors, hiring is picking up, and spending is increasing. Employment moved higher, and consumer spending rebounded strongly in May. We have entered an important new phase and have done so sooner than expected. While this bounceback in economic activity is welcome, it also presents new challenges—notably, the need to keep the virus in check.

While recent economic data offer some positive signs, we are keeping in mind that more than 20 million Americans have lost their jobs, and that the pain has not been evenly spread. The rise in joblessness has been especially severe for lower-wage workers, for women, and for African Americans and Hispanics. This reversal of economic fortune has caused a level of pain that is hard to capture in words as lives are upended amid great uncertainty about the future.

Output and employment remain far below their pre-pandemic levels. The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus. A full recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.

The path forward will also depend on the policy actions taken at all levels of government to provide relief and to support the recovery for as long as needed.

The Federal Reserve's response to these extraordinary developments has been guided by our mandate to promote maximum employment and stable prices for the American people as well as our role in fostering the stability of the financial system. Our actions and programs directly support the flow of credit to households, to businesses of all sizes, and to state and local governments. These programs benefit Main Street by providing financing where it is not otherwise available, helping employers to

keep their workers, and allowing consumers to continue spending. In many cases, by serving as a backstop to key financial markets, the programs help increase the willingness of private lenders to extend credit and ease financial conditions for families and businesses across the country. The passage of the CARES Act by Congress was critical in enabling the Federal Reserve and the Treasury Department to establish many of these lending programs. We are strongly committed to using these programs, as

well as our other tools, to do what we can to provide stability, to ensure that the recovery will be as strong as possible, and to limit lasting damage to the economy.

In discussing the actions we have taken, I will begin with monetary policy. In March, we lowered our policy interest rate to near zero, and we expect to maintain interest rates at this level until we are confident that the economy has weathered recent events and is on track to achieve our maximum-employment and price-stability goals.

In addition to these steps, we took forceful measures in four areas: open market operations to restore market functioning; actions to improve liquidity conditions in short-term funding markets; programs, in coordination with the Treasury Department, to facilitate more directly the flow of credit to households, businesses, and state and local governments; and measures to encourage banks to use their substantial capital and liquidity buffers built up over the past decade to support the economy

during this difficult time.

Let me now turn to our open market operations. As tensions and uncertainty rose in mid-March, investors moved rapidly toward cash and shorter-term government securities, and the markets for Treasury securities and agency mortgage-backed securities, or MBS, started to experience strains. These markets are critical to the overall functioning of the financial system and to the transmission of monetary policy to the broader economy. In response, the Federal Open Market Committee purchased

Treasury securities and agency MBS in the amounts needed to support smooth market functioning. With these purchases, market conditions improved substantially, and in early April we began to gradually reduce our pace of purchases. To sustain smooth market functioning and thereby foster the effective transmission of monetary policy to broader financial conditions, we will increase our holdings of Treasury securities and agency MBS over the coming months at least at the current pace. We will

closely monitor developments and are prepared to adjust our plans as appropriate to support our goals.

Amid the tensions and uncertainties of mid-March and as a more adverse outlook for the economy took hold, investors exhibited greater risk aversion and pulled away from longer-term and riskier assets as well as from some money market mutual funds. To help stabilize short-term funding markets, we lengthened the term and lowered the rate on discount window loans to depository institutions. The Board also established, with the approval of the Treasury Department, the Primary Dealer Credit

Facility (PDCF) under our emergency lending authority in section 13(3) of the Federal Reserve Act. Under the PDCF, the Federal Reserve provides loans against good collateral to primary dealers that are critical intermediaries in short-term funding markets. Similar to the large-scale purchases of Treasury securities and agency MBS that I mentioned earlier, this facility helps restore normal market functioning.

In addition, under section 13(3) and together with the Treasury Department, we set up the Commercial Paper Funding Facility, or CPFF, and the Money Market Mutual Fund Liquidity Facility, or MMLF. Millions of Americans put their savings into these markets, and employers use them to secure short-term funding to meet payroll and support their operations. Both of these facilities have equity provided by the Treasury Department to protect the Federal Reserve from losses. After the announcement and

implementation of these facilities, indicators of market functioning in commercial paper and other short-term funding markets improved substantially, and rapid outflows from prime and tax-exempt money market funds stopped.

In mid-March, offshore U.S. dollar funding markets also came under stress. In response, the Federal Reserve and several other central banks announced the expansion and enhancement of dollar liquidity swap lines. In addition, the Federal Reserve introduced a new temporary Treasury repurchase agreement facility for foreign monetary authorities. These actions helped stabilize global U.S. dollar funding markets, and they continue to support the smooth functioning of U.S. Treasury and other

financial markets as well as U.S. economic conditions.

As it became clear the pandemic would significantly disrupt economies around the world, markets for longer-term debt also faced strains. The cost of borrowing rose sharply for those issuing corporate bonds, municipal debt, and asset-backed securities (ABS) backed by consumer and small business loans. In effect, creditworthy households, businesses, and state and local governments were unable to borrow at reasonable rates and other terms, which would have further reduced economic activity. In

addition, small and medium-sized businesses that traditionally rely on bank lending faced large increases in their funding needs as measures taken to contain the spread of the virus forced them to temporarily close or limit operations, substantially curtailing revenues.

To support the longer-term financing that is critical to economic activity, the Federal Reserve, in cooperation with the Department of the Treasury and using equity provided for that purpose under the CARES Act, announced a number of emergency lending facilities under section 13(3) of the Federal Reserve Act. These facilities are designed to ensure that credit would flow to borrowers and thus support economic activity.

On March 23, the Board announced that it would support consumer and business lending by establishing the Term Asset-Backed Securities Loan Facility (TALF). The TALF is authorized to extend up to $100 billion in loans and is backed by $10 billion in CARES Act equity. This facility lends against top-rated securities backed by auto loans, credit card loans, other consumer and business loans, commercial mortgage-backed securities, and other assets. The TALF supports credit access by consumers and

businesses and provides liquidity to the broader ABS market. The facility made its first loans on June 25, and, to date, has extended $252 million in loans to eligible borrowers. Since the TALF was announced, ABS spreads have contracted significantly. Thus, the facility might be used relatively little and mainly serve as a backstop, assuring lenders that they will have access to funding and giving them the confidence to make loans to households and businesses.

To support the credit needs of large employers, the Federal Reserve also established the Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF). These facilities primarily purchase bonds issued by U.S. companies that were investment grade on March 22, 2020. The two facilities have a combined purchase capacity of up to $750 billion and are backed by $75 billion in CARES Act equity. Final terms and operational details on the PMCCF were

announced on June 29, and it stands ready to purchase newly issued corporate bonds and syndicated loans, serving as a backstop for businesses seeking to refinance their existing credit or obtain new funding. The SMCCF buys outstanding corporate bonds and shares in corporate bond exchange-traded funds (ETFs) to facilitate smooth functioning of the secondary market. The SMCCF complements the PMCCF, because improvements in secondary-market functioning associated with the SMCCF facilitate access by

companies to bond and loan markets on reasonable terms. The SMCCF launched with ETF purchases on May 12. Earlier this month, the facility began gradually reducing purchases of ETFs as it started buying a broad and diversified portfolio of individual corporate bonds to more directly support smooth functioning and market liquidity in the secondary market. Purchase volumes are tied to market functioning and are currently at very low levels. The facility currently holds a total of about $10 billion

in bonds and ETF shares.

Following the announcement of the two corporate credit facilities in late March, conditions in the corporate bond market improved significantly. Credit spreads on investment-grade bonds retraced much of the widening experienced in February and March, and issuance in the primary market rebounded strongly. In the secondary market, liquidity also improved, and by mid-April, flows out of mutual funds and ETFs specializing in corporate bonds reversed.

The Federal Reserve also launched the Main Street Lending Program, which is designed to provide loans to small and medium-sized businesses that were in good financial standing before the pandemic; such firms generally are dependent on bank lending for credit because they are too small to tap bond markets directly. Under the Main Street program, banks originate new loans or increase the size of existing loans to eligible businesses and sell loan participations to the Federal Reserve. The

facility is backed by $75 billion in CARES Act equity and can purchase up to $600 billion in loan participations. The Federal Reserve has published all of the legal documents that borrowers and lenders will need to sign under the program and lender registration began on June 15. Loan participations will be purchased soon. Additionally, the Federal Reserve recently sought feedback on a proposal to expand the Main Street program to include loans made to small and medium-sized nonprofit

organizations, such as hospitals and universities. Nonprofits provide vital services around the country, and the program would likewise offer them support.

While businesses in certain sectors that were particularly hard hit by the pandemic have reported continued difficulty in accessing credit, the Small Business Administration's Paycheck Protection Program (PPP), which draws from existing bank lines, has apparently met the immediate credit needs of many small businesses. In the months ahead, Main Street loans may prove a valuable resource for firms that were in sound financial condition prior to the pandemic.

To bolster the effectiveness of the Small Business Administration's PPP, on April 16, the Federal Reserve launched the Paycheck Protection Program Liquidity Facility. The facility supplies liquidity to lenders backed by their PPP loans to small businesses and has the capacity to lend up to the full amount of the PPP. As of last week, the facility held over $65 billion in outstanding term loans to participating financial institutions. The most recent monthly survey from the National Federation

of Independent Business released in May indicates that small businesses have been able to meet their funding needs in recent months largely due to the PPP.

To help state and local governments better manage cash flow pressures in order to continue to serve households and businesses in their communities, the Federal Reserve, together with the Treasury Department, established the Municipal Liquidity Facility (MLF). The MLF is backed by $35 billion of CARES Act equity and has the capacity to purchase up to $500 billion of short-term debt directly from U.S. states, counties, cities, and certain multistate entities. The facility became operational on

May 26, and, to date, the MLF has purchased $1.2 billion worth of short-term municipal debt. With the MLF and other facilities in place as a backstop to the private market, many parts of the municipal bond market have significantly recovered from the unprecedented stress experienced earlier this year. Municipal bond yields have declined considerably, issuance has been robust over the past two months, and market conditions have improved.

The tools that the Federal Reserve is using under its 13(3) authority are for times of emergency, such as the ones we have been living through. When economic and financial conditions improve, we will put these tools back in the toolbox.

The final area where we took steps was in bank regulation. The Board made several adjustments, many temporary, to encourage banks to use their positions of strength to support households and businesses. Unlike the 2008 financial crisis, banks entered this period with substantial capital and liquidity buffers and improved risk-management and operational resiliency. As a result, they have been well positioned to cushion the financial shocks we are seeing. In contrast to the 2008 crisis when

banks pulled back from lending and amplified the economic shock, in this crisis they have greatly expanded loans to customers and have helped support the economy.

The Federal Reserve has been entrusted with an important mission, and we have taken unprecedented steps in very rapid fashion over the past few months. In doing so, we embrace our responsibility to the American people to be as transparent as possible. With regard to the facilities backed by equity from the CARES Act, we have conducted broad outreach and sought public input that has been crucial in their development. For example, in response to comments received, the Treasury and the Federal

Reserve have made a number of changes to expand the scope of the Main Street Lending Program to cover a broader range of borrowers and to increase the flexibility of loan terms. And we are now disclosing and will continue to disclose, on a monthly basis, names and details of participants in each facility; amounts borrowed and interest rate charged; and overall costs, revenues, and fees for each of these facilities.

We recognize that our actions are only part of a broader public-sector response. Congress's passage of the CARES Act was critical in enabling the Federal Reserve and the Treasury Department to establish many of the lending programs. The CARES Act and other legislation provide direct help to people, businesses, and communities. This direct support can make a critical difference not just in helping families and businesses in a time of need, but also in limiting long-lasting damage to our

economy. We understand that the work of the Federal Reserve touches communities, families, and businesses across the country. Everything we do is in service to our public mission. We are committed to using our full range of tools to support the economy and to help assure that the recovery from this difficult period will be as robust as possible.

Thank you. I'd be happy to take your questions.

Source: Federal Reserve Board of Governors

|

| Archbishop Carlo Maria Viganò's Letter to President Trump |

.jpg)

June 7, 2020 ~ Carlo Maria Viganò

Holy Trinity Sunday

Mr. President,

In recent months we have been witnessing the formation of two opposing sides that I would call Biblical: the children of light and the children of darkness. The children of light constitute the most conspicuous part of humanity, while the children of darkness represent an absolute minority. And yet the former are the object of a sort of discrimination which places them in a situation of moral inferiority with respect to their adversaries, who often hold strategic positions in government, in

politics, in the economy and in the media. In an apparently inexplicable way, the good are held hostage by the wicked and by those who help them either out of self-interest or fearfulness.

These two sides, which have a Biblical nature, follow the clear separation between the offspring of the Woman and the offspring of the Serpent.

On the one hand, there are those who, although they have a thousand defects and weaknesses, are motivated by the desire to do good, to be honest, to raise a family, to engage in work, to give prosperity to their homeland, to help the needy, and, in obedience to the Law of God, to merit the Kingdom of Heaven. On the other hand, there are those who serve themselves, who do not hold any moral principles, who want to demolish the family and the nation, exploit workers to make themselves unduly

wealthy, foment internal divisions and wars, and accumulate power and money: for them the fallacious illusion of temporal well-being will one day – if they do not repent – yield to the terrible fate that awaits them, far from God, in eternal damnation.

We will also discover that the riots in these days were provoked by those who, seeing that the virus is inevitably fading and that the social alarm of the pandemic is waning, necessarily have had to provoke civil disturbances, because they would be followed by repression which, although legitimate, could be condemned as an unjustified aggression against the population.

The same thing is also happening in Europe, in perfect synchrony.

It is quite clear that the use of street protests is instrumental to the purposes of those who would like to see someone elected in the upcoming presidential elections who embodies the goals of the deep state and who expresses those goals faithfully and with conviction. It will not be surprising if, in a few months, we learn once again that hidden behind these acts of vandalism and violence there are those who hope to profit from the dissolution of the social order so as to build a world

without freedom: Solve et Coagula, as the Masonic adage teaches.

Although it may seem disconcerting, the opposing alignments I have described are also found in religious circles. There are faithful Shepherds who care for the flock of Christ, but there are also mercenary infidels who seek to scatter the flock and hand the sheep over to be devoured by ravenous wolves. It is not surprising that these mercenaries are allies of the children of darkness and hate the children of light: just as there is a deep state, there is also a deep church that betrays its

duties and forswears its proper commitments before God. Thus the Invisible Enemy, whom good rulers fight against in public affairs, is also fought against by good shepherds in the ecclesiastical sphere. It is a spiritual battle, which I spoke about in my recent Appeal which was published on May 8.

In society, Mr. President, these two opposing realities co-exist as eternal enemies, just as God and Satan are eternal enemies. And it appears that the children of darkness – whom we may easily identify with the deep state which you wisely oppose and which is fiercely waging war against you in these days – have decided to show their cards, so to speak, by now revealing their plans.

They seem to be so certain of already having everything under control that they have laid aside that circumspection that until now had at least partially concealed their true intentions.

The investigations already under way will reveal the true responsibility of those who managed the COVID emergency not only in the area of health care but also in politics, the economy, and the media. We will probably find that in this colossal operation of social engineering there are people who have decided the fate of humanity, arrogating to themselves the right to act against the will of citizens and their representatives in the governments of nations.

For the first time, the United States has in you a President who courageously defends the right to life, who is not ashamed to denounce the persecution of Christians throughout the world, who speaks of Jesus Christ and the right of citizens to freedom of worship. Your participation in the March for Life, and more recently your proclamation of the month of April as National Child Abuse Prevention Month, are actions that confirm which side you wish to fight on. And I dare to believe that both

of us are on the same side in this battle, albeit with different weapons.

For this reason, I believe that the attack to which you were subjected after your visit to the National Shrine of Saint John Paul II is part of the orchestrated media narrative which seeks not to fight racism and bring social order, but to aggravate dispositions; not to bring justice, but to legitimize violence and crime; not to serve the truth, but to favor one political faction. And it is disconcerting that there are Bishops – such as those whom I recently denounced – who, by their words,

prove that they are aligned on the opposing side.

They are subservient to the deep state, to globalism, to aligned thought, to the New World Order which they invoke ever more frequently in the name of a universal brotherhood which has nothing Christian about it, but which evokes the Masonic ideals of those who want to dominate the world by driving God out of the courts, out of schools, out of families, and perhaps even out of churches.

The American people are mature and have now understood how much the mainstream media does not want to spread the truth but seeks to silence and distort it, spreading the lie that is useful for the purposes of their masters. However, it is important that the good – who are the majority – wake up from their sluggishness and do not accept being deceived by a minority of dishonest people with unavowable purposes.

It is necessary that the good, the children of light, come together and make their voices heard. What more effective way is there to do this, Mr. President, than by prayer, asking the Lord to protect you, the United States, and all of humanity from this enormous attack of the Enemy? Before the power of prayer, the deceptions of the children of darkness will collapse, their plots will be revealed, their betrayal will be shown, their frightening power will end in nothing, brought to light and

exposed for what it is: an infernal deception.

Mr. President, my prayer is constantly turned to the beloved American nation, where I had the privilege and honor of being sent by Pope Benedict XVI as Apostolic Nuncio. In this dramatic and decisive hour for all of humanity, I am praying for you and also for all those who are at your side in the government of the United States. I trust that the American people are united with me and you in prayer to Almighty God.

United against the Invisible Enemy of all humanity, I bless you and the First Lady, the beloved American nation, and all men and women of good will.

Carlo Maria Viganò

Titular Archbishop of Ulpiana

Former Apostolic Nuncio to the United States of America

|

| Battle to Save the Republic |

Humanity is good, but, when we let our guard down we allow darkness to infiltrate and destroy. Like past battles fought, we now face our greatest battle at present, a battle to save our Republic, our way of life, and what we decide (each of us) now will decide our future.

Will we be a free nation under God? Or will we cede our freedom, rights and liberty to the enemy? We all have a choice to make.

Evil [darkness] has never been so exposed to light. They can no longer hide in the shadows. Our system of government has been infiltrated by corrupt and sinister elements.

Democracy was almost lost forever.

Think HRC install: [2+] Supreme Court Justices, 200+ judges, rogue elements expanded inside DOJ, FBI, CIA, NSA, WH, STATE, …….removal 2nd amendment, border etc. ……… America for sale: China, Russia, Iran, Syria…….ISIS & AL Q expansion…….expansion surv of domestic citizens…….modify/change voter rules and regulations allow illegals+ballot harvesting w/ SC backed liberal-social opinion………sell off of military to highest bidder to fight internal long-standing wars……..

Their thirst for a one world order [destruction of national sovereignty] serves to obtain control over America [and her allies [think EU]] by diluting your vote to oblivion and installing a new one world ruling party.

The start of this concept began with organizations such as: world health org, world trade org, united nations, ICC, NATO, etc., [all meant to weaken the United States] also the formation of EU through threat [con] of close proximity attack [attack on one is an attack on all – sales pitch to gen public – fear control].

Re: EU _did each member nation cede sovereignty to Brussels? Re: EU _each member must implement EU rules and regulations in all areas [think immigration, currency, overall control].

Their thirst to remove your ability to defend yourself serves to prevent an uprising to challenge their control. There is a fundamental reason why our enemies dare not attack [invade] our borders [armed citizenry].

If America falls so does the world.

If America falls darkness will soon follow.

Only when we stand together, only when we are united, can we defeat this highly entrenched dark enemy.

Their power and control relies heavily on an uneducated population.

A population that trusts without individual thought.

A population that obeys without challenge.

A population that remains outside of free thought, and instead, remains isolated living in fear inside of the closed-loop echo chamber of the controlled mainstream media.

This is not about politics. This is about preserving our way of life and protecting the generations that follow.

We are living in Biblical times.

Children of light vs children of darkness.

United against the Invisible Enemy of all humanity.

|

| Department of Justice And Federal Trade Commission Issue New Vertical Merger Guidelines |

2020 Guidelines More Accurately Represent Agencies’ Merger Review Process

The Department of Justice and Federal Trade Commission issued today new Vertical Merger Guidelines that outline how the federal antitrust agencies evaluate the likely competitive impact of mergers and whether those mergers comply with U.S. antitrust law. These new Vertical Merger Guidelines mark the first time the Department and the FTC have issued joint guidelines on vertical mergers, and represent the first major revision to guidance on vertical mergers since the Department’s 1984

Non-Horizontal Merger Guidelines, which the Department withdrew in January of this year.

In March 2019, Assistant Attorney General Makan Delrahim of the Department of Justice’s Antitrust Division announced that a draft of new vertical merger guidelines was underway, following an FTC workshop in Fall 2018 on whether new vertical merger guidelines should be issued.

“As a joint effort of DOJ and the FTC, the new vertical merger guidelines will provide greater transparency and predictability to the marketplace when businesses combine at different levels of the supply chain," said Deputy Attorney General Jeff Rosen.

“These new Vertical Merger Guidelines provide transparency in the important area of vertical merger analysis,” said Assistant Attorney General Delrahim. “They explain our investigative practices as we apply them today and have applied them in recent years. The guidelines will give greater predictability and clarity to the business community, the bar, and enforcers. I am grateful for the commitment, thoroughness, and dedication with which staff from both agencies worked on this project. This

has been a successful process because of our robust public engagement and our excellent collaborative relationship with the FTC.”

“These new Vertical Merger Guidelines are an important step forward in maintaining vigorous antitrust enforcement, and reaffirm our commitment to challenge vertical mergers that are anticompetitive and would harm American consumers,” said FTC Chairman Joe Simons. “The new guidelines reflect our current enforcement approach and, through increased transparency, will help businesses and practitioners understand how we evaluate vertical transactions. The new Guidelines also reflect our strong

collaboration with the Department of Justice, and the substantial input that we received from the public.”

Vertical mergers combine two or more companies that operate at different levels in the same supply chain. A primary goal of the new Vertical Merger Guidelines is to help the agencies identify and challenge competitively harmful mergers while avoiding unnecessary interference with mergers that either are competitively beneficial or likely will have no competitive impact on the marketplace. To accomplish this, the guidelines detail the techniques and main types of evidence the agencies

typically use to predict whether vertical mergers may substantially lessen competition. The Guidelines will help businesses, antitrust practitioners and other interested persons by increasing transparency into the agencies’ principal analytical techniques, practices, and enforcement policies for evaluating vertical transactions.

The new Vertical Merger Guidelines reflect the agencies’ analysis of vertical mergers. The revised guidelines:

- Explain that mergers often present both horizontal and vertical elements, and the agencies may apply both the Horizontal Merger Guidelines and the Vertical Merger Guidelines in their evaluation of a transaction, as part of a fact-specific process that involves a variety of tools to determine whether a merger may substantially lessen competition.

- Clarify that its analytical techniques, practices, and enforcement policies apply to a range of non-horizontal transactions, including strictly vertical mergers, “diagonal” mergers, and vertical issues that can arise in mergers of complement.

- Clarify that when the agencies identify a potential competitive concern in a relevant market, they will also specify one or more related products. A related product is a product or service that is supplied or controlled by the merged firm and is positioned vertically or is complementary to the products and services in the relevant market.

- Provide detailed discussions, including multiple diverse examples, of the “raising rivals’ costs” and “foreclosure” theories of harm. In recent decades, these theories of harm have been the principle theories investigated in merger reviews.

- Identify conditions under which a vertical merger would not require an extensive investigation, because the merger does not create or enhance the merged firm’s incentive or ability to harm rivals.

- Emphasize that analyzing efficiencies is an important part of reviewing vertical mergers.

- Explain in detail the analysis of the elimination of double marginalization (“EDM”), which economists emphasize is a frequent procompetitive result of vertical transactions.

The new guidelines are the culmination of a process that dates back to the start of the FTC’s Hearings on Competition and Consumer Protection in the 21st Century in June 2018. In June 2018, and then again in the October 2018, the Commission sought comment on the legal and economic analysis of vertical mergers, and whether new Vertical Merger Guidelines should be issued by the antitrust agencies. In November 2018, the Commission held a public hearing to discuss the proper scope of new

guidelines. In the spring of 2019, both agencies began working on revisions to the 1984 Non-Horizontal Merger Guidelines, and began sharing drafts of proposed new guidelines in the summer of 2019. On January 10, 2020, the agencies jointly released a draft version of the Vertical Merger Guidelines; the agencies received 74 substantive comments on the draft. A public workshop to discuss the draft was held on March 11, 2020 during which staff from both agencies moderated debate and discussion on

the draft Vertical Merger Guidelines. The guidelines released today modify the draft released in January to incorporate comments from the public.

|

|

|

.jpg)

About us

About us