| September 30, 2019 |

| Offshore Investment Guide |

|

Dear ,

If your investment objective is to generate an above average return in a short order, then your timing is perfect! The big trading season for the 2019 year is upon us. Market makers are placing final trades and calling all investors to get onboard.

An Exchanged Traded Note is tax optimized and has a built-in default protection. A registered Security with exceptional timing and high ROI.

One such note is being managed by recognized BaFin-regulated boutique asset manager Quantumrock Capital, in the

market since 2012.

Learn how you can capitalize on an exchange traded note.

|

| Inside the World’s Most Elite (and Secret) Traders’ Club |

The nameless group confers “a hunting license” that lets an investor sit at the “big boy table and make high-level trades not available to stupid amateurs.”

In an industry where power and influence are measured in dollars and cents, this may be the most exclusive club in finance: The price of admission is at least $25 million.

It has no name and no board of directors but has a roster drawn from the world’s wealthiest and most successful traders. Members essentially become their own one-person firms, even firms within firms, by gaining a seal of approval to deal in the complex products typically reserved for institutions that manage hundreds of billions of dollars. And all without drawing the attention of Wall Street’s everyday millionaires.

Their ranks are getting more selective. While no one keeps count, people in the industry guesstimate that the total peaked at no more than 3,000 a decade ago and has shrunk considerably since the financial crisis. Months of interviews have yielded the identities of just 12 individuals who held the prize: an ISDA master agreement.

Read the entire article on Bloomberg Markets

Private Placement Trading in the U.S.

Although these placements are subject to the Securities Act of 1933, the securities offered do not have to be registered with the Securities and Exchange Commission if the issuance of the securities conforms to an exemption from registrations as set forth in the Securities Act of 1933 and the associated SEC rules put into effect.

Most private placements are offered under the Rules known as Regulation D. Different rules under Regulation D provide stipulations for offering a Private Placement, such as required financial criteria for investors or solicitation allowances.[3] Private placements may typically consist of offers of common stock or preferred stock or other forms of membership interests, warrants or promissory notes (including convertible promissory notes), bonds, and purchasers are often

institutional investors such as banks, insurance companies or pension funds.

Common exemptions from the Securities Act of 1933 allow an unlimited number of accredited investors to purchase securities in an offering. Generally, accredited investors are those with a net worth in excess of $1 million or annual income exceeding $200,000 or $300,000 combined with a spouse.

Under these exemptions, no more than 35 non-accredited investors may participate in a private placement. In most cases, all investors must have sufficient financial knowledge and experience to be capable of evaluating the risks and merits of investing in a company.

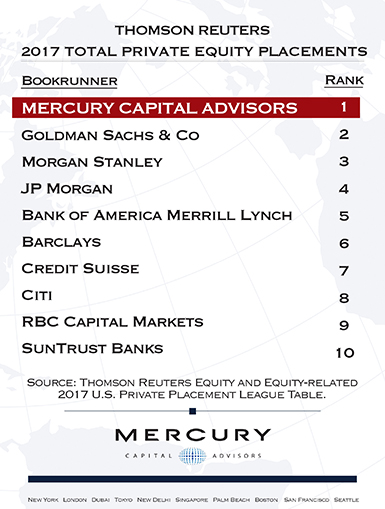

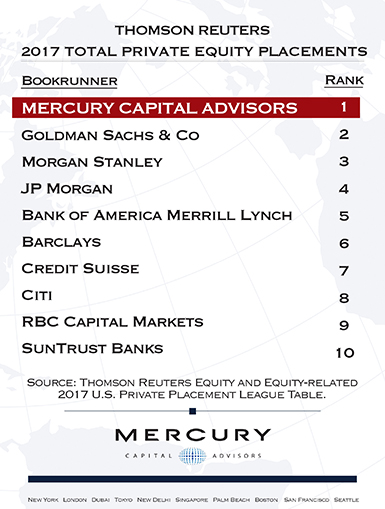

Ranking

Equity & Equity-related (AM1) - First Half 2015

| Placement Agents |

2015 Rank |

2014 Rank |

Proceeds |

Market Sh (%) |

Market Share Ch. |

| Mercury Capital Advisors LLC |

1 |

1 |

3,753.8 |

24.5 |

7.2 |

| JP Morgan & Co |

2 |

5 |

2,264.7 |

14.8 |

6.1 |

| Bank of America Merrill Lynch |

3 |

2 |

996.6 |

6.5 |

-5.4 |

| Morgan Stanley |

4 |

6 |

729.3 |

4.8 |

-3.3 |

| RBC Capital Markets |

5 |

12 |

658.0 |

4.3 |

2.0 |

| Wells Fargo & Co |

6 |

10 |

611.0 |

4.0 |

1.3 |

| Goldman Sachs & Co |

7 |

4 |

598.6 |

3.9 |

-5.7 |

| Credit Suisse |

8 |

7 |

566.5 |

3.7 |

-1.8 |

| HSBC Holdings PLC |

9 |

13 |

423.8 |

2.8 |

1.3 |

| Jefferies LLC |

10 |

11 |

406.4 |

2.7 |

0 |

| UBS |

11 |

12 |

344.6 |

2.3 |

0.8 |

| Deutsche Bank |

12 |

3 |

337.1 |

2.2 |

-8.1 |

| Barclays |

13 |

9 |

331.7 |

2.2 |

-1 |

| BMO Capital Markets |

14 |

- |

325 |

2.1 |

2.1 |

| Nomura |

15 |

19 |

266.7 |

1.7 |

1.0 |

To learn more about the timing opportunity for an Exchanged Traded Note, or request an intro to a registered and regulated Licensed Trader.

|

| Why Investcorp is buying Mercury |

We don’t often see managers buying placement agents, but in this instance the rationale is clear.

In an industry in which growth is currently the norm, Investcorp stands out as pursuing it faster than most.

The Bahrain-listed alternatives investment firm has been on an acquisition spree in the last year. It forayed into Asia with a $250 million anchor investment in a Chinese manager’s tech fund and the acquisition of Mumbai-based IDFC Alternatives’ private equity and real estate units. The firm has also picked up a 40 percent strategic stake in a Swiss private bank and launched Strategic Capital Group, a unit that will acquire minority stakes in mid-sized alternative asset managers.

This activity is all designed to fuel an ambitious growth plan to grow AUM to $50 billion in the medium-term from $22.5 billion as of end-December 2018. It also puts into perspective the firm’s acquisition of New York-based placement firm Mercury Capital Advisors.

Investcorp has acquired 100 percent of Mercury. Four representatives from Investcorp will join Mercury’s board of directors post-acquisition, with Mercury’s management team continuing to run the business.

It’s not totally unheard of for a GP to buy a placement agent, but it is rare. Blackstone used to own Park Hill Group before spinning off the business in September 2015 to combine with PJT Partners. We are more used to seeing investment banks pick up placement agents, such as Houlihan Lokey’s acquisition of BearTooth Advisors last year or Stifel Financial and Eaton Partners in 2015.

For the Bahrain-listed firm, it’s a strategic play. Investcorp is at a point at which raising institutional capital and reaching new investors are top priorities. The firm has historically raised the bulk of its capital from wealthy families and individuals in the Middle East. This year it has already sealed two big secondaries transactions that have ushered Coller Capital and Harbourvest into its investor base and raised fresh capital for both its buyout and tech sector programmes. The firm

raised $548 million in the last six months of 2018, according to its most recent results, more than double what it raised in the same period the year before.

The acquisition of Mercury brings more than 50 fundraisers across 14 offices into a firm with global growth plans. Last year, Mercury facilitated over $6.5 billion in aggregate capital commitments in North America, Asia and Europe across private equity, private credit, real estate, secondaries and direct transactions. Mercury also has iFunds, a fintech platform offering family offices and wealth advisors access to alternatives investments.

Mercury will continue to operate as an independent placement agent, the two firms said this week, but it would defy logic to think its fundraisers won’t be unleashed on Investcorp’s own products.

In this context, the deal makes perfect sense.

Source: Mercury Capital Advisors

The offshore financial structure information can be found here: Offshore Capital Structure

|

| Exchanged Traded Note - Features |

|

The investment objective is to generate an above average return through investment in heavily discounted

corporate bonds, fixed income bonds, private placement notes, the iTRAXX, individual constituents of the

ITRAXX and comparable indices, ETFs, futures, futures on crypto currencies, options and stocks; so called

special opportunities.

As integral part of the investment strategy such opportunities are continuously and

systematically searched for and identified on global financial markets. After the evaluation process positions

are taken to create a diversified portfolio of such instruments.

An AI/Machine Learning system is used to

continuously analyze the price/volume data of the individual constitutes with the objective to identify

opportunities, change in implied risk and risk/reward ratio. Based on that weighting as well as the portfolio

itself is adapted accordingly.

Depending on the market situation the portfolio will be complemented with investments in highly liquid and

stable fixed income bonds.

AI-based, non-correlating investment strategies in futures, equities, ETFs, indices,

options well as futures on cryptocurrencies are also applied to diversify and stabilize the portfolio and

generate additional return opportunities.

To enhance the return characteristic further and to provide a hedge

as well as to optimize cash positions, automated investment strategies trading in the S&P500 index volatility

market will be added.

Learn how you can capitalize on an exchange traded note.

|

|

|

About us

About us