| March 31, 2018 |

| Offshore Investment Guide |

|

Hi ,

International regulatory exchange of information agreements directly target ”hiding behind” foreign financial account entities Trusts, Foundations, IBC, LLC and Offshore Life Insurance Policies are now a red flag pointing at you.

Online trading, with global tax compliance, can occur from an overseas retirement plan or a part of an offshore investment account, can be designed to meet your specific needs; apply within.

|

| Trading Risk for Security Offshore |

The real opportunity for the overseas retirement plan structure (i.e. 402b) is to be a start-up company plan in which the management and staff are all participating. The structure would hold the stock of the employees/management, would be pre-tax, and would be funded initially out of monthly employee contributions, and eventually out of performance-related options, grants or company matching payments (like a 401k often is).

The structure may invest in its own company stock, or even other investments because it is company plan, the costs of establishment should be low on a per member basis.

Members like one example who has significant assets and interest in more complex plans, could set up his own plan for those investments. But he is in a position to introduce these plans to the start-ups he helps set up. Furthermore, many of these existing investments he has are in options or zero-value grant shares. In other words, theses new assets really have no market value because the company is just starting up. Therefore, the tax consequences of moving these existing corporate assets

into a 402b - a taxable event - might not cost a nickel in some cases, even if the "theoretical" value of the investment once the company meets its targets could be in excess of $1M.

This style of 402b is tax deferred on gains and accumulation. It is a foreign regulated, registered and recognized retirement plan that is also acknowledged in the Foreign Account Tax Compliance Act (FATCA) as exempt from withholding. It is recognized in the O.E.C.D. Common Reporting Standard Automatic Exchange of Information (AEOI) globally as tax rules compliant and exempt non-reporting Foreign Financial Institution and excluded for reporting account.

The money flow must go from the funder to the Anti Money Laundering (AML) Licensed and recognized 402(b) plan registered Occupational Retirement Scheme Overseas (ORSO) and US Global Intermediary Identification Number (GIIN)- regulated Trustee Account that is Automatic Exchange of Information (AEOI) tax rules compliant and exempt; non-reporting Foreign Financial Institution (FFI) and excluded.

So In a start-up environment, top managers are not really concerned about upfront tax liability at all. They would kill for something to protect them from the tax on the capital gains of future investments. Middle managers would be interested in pre-tax contributions out of their monthly pay-checks.

The 402b Opportunity is Now! This structure (type) can serve both classes of members, without challenging fundamental principles.

|

| Simple Math of Non-Qualified Deferred Compensation (NQDC) |

A nonqualified deferred compensation (NQDC) plan is an elective or non-elective plan, agreement, method, or arrangement between an employer and an employee (or service recipient and service provider) to pay the employee or independent contractor compensation in the future.

An overseas retirement plan can provide a legal and tax compliant NQDC personal investment structure, that enables an individual who takes the time and pays the expense to create, a way to defer income tax and capital gains tax, until after the completion of the plan, or liquidation and repatriation of those assets.

A person is in the 24% tax bracket goes out and hires an Attorney that cost $20,000.00 that means his actual out of pocket cost is about $26,000.00; The price to set-up our recommended program is $25,000.00 and could be paid out of pre-tax deferred income contribution.

Bitcoin and crypto asset values have dropped substantially in the past three months indicates a good time to change ownership of digital assets now, prior to the climb back up. We suggest that holders of digital assets invest offshore by transferring ownership to your own customized retirement plan. Legally tax deferred, asset protection.

Conventional wisdom about income tax deferral is fraught with misconceptions.

Here are the two most egregious myths.

Myth No. 1

There is no economic advantage to deferring income tax. Whether you get paid now or later, you end up with the same amount of money (That statement is a Myth).

Myth No. 2

Deferrals must be structured as a fixed annuity. (That statement is a Myth)

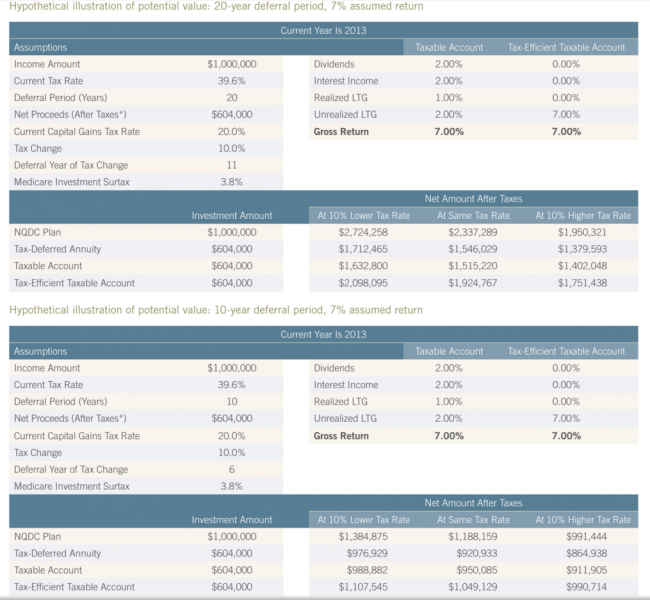

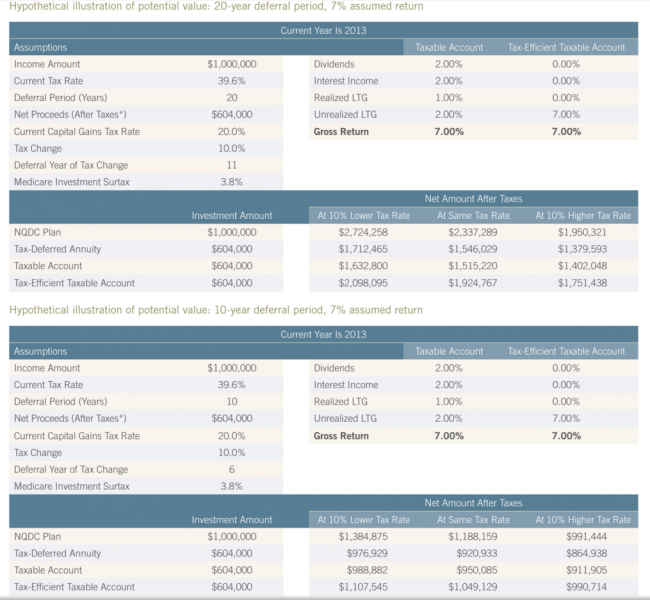

A chart comparison shows Non-Qualified Deferred Compensation (NQDC) growth values beats everything else.

NQDC Growth Chart

|

| Offshore Project Funding Structures |

Historic structures: transfer pricing, diverted profit tax, carried interest no longer function for offshore tax planning.

Investment vehicles require a look at what the future is to be.

Governments and governance look through everything. Everything is considered a tax avoidance scheme except that which is formally recognized and registered as not.

Excluded does not mean to include it just in case.

Practical application examples of asking the right question:

- Direct investment in Real Estate projects are subject to capital gains tax.

- Providing project financing via a Clean Nominee Bank Account, pension fund structure, is entirely different than a direct investment into real estate. In other words, it depends on how the pension fund, which owns the finance company, is providing project financing. For example a profit share of a development is legally different to the sale of those properties by that pension fund.

Project financing is not a gain on real estate it is a gain on having put up the money and Double Tax Agreement* specifically deals with capital gains with exception.

* see s.323 Tax Exemption from FIRPTA for U.S. property exemption

Knowing the right questions for offshore tax planning and the right structure are reasons tax attorneys with experience need to be engaged.

|

|

|

About us

About us