Cash Flows: Legal Clean Nominee Account and Banking

Published: Sat, 11/11/17

Dear ,

The legal cash flow is never from your source of funds to the project.

Therefore, the legal structure must be set-up prior to funding your projects, investments and cash flows.

A Typical Trust structure integrates the Trustee and the Custodian.

This Clean Nominee Bank Account must segregate the Trustee and the Custodian, which means the legal cash flow and the banking cash flow are different.

But first, a brief summary of why cash flow is crucial.

Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA) is a Classification System.

All cross-border cash flows and all foreign financial accounts, both the accounts and the cash flow is reported continuously except the category which is not reported. So we look at a classification that is not reported and recognized pre-qualified tax compliant.

The largest investors in the world are Occupational Retirement Funds which have a Clean Nominee Bank Account.

This retirement plan represents the ability to seamlessly invest and trade capital by means of an acknowledged non-reporting financial institution and exempt beneficiary investment account.

This legal retirement plan framework is available to anyone, living anywhere, working in any occupation for the dominant purpose of providing a retirement plan.

The general anti-avoidance rule for income tax broadly states: did you carry out a series of steps, arrangement or plan for the sole or dominant purpose of obtaining a tax benefit. The sole and dominant purpose is a retirement plan.

Difference between a bank account with a retirement plan label on it and an occupational retirement Clean Nominee Bank Account is defined in both the CRS and FATCA.

The International Organization of Pension Supervisors( IOPS's), a 2nd world government, sets down how a government regulated, registered and recognized retirement plan should look, IOPS has defined the qualified retirement plan classification.

A Qualified Foreign Retirement Plan is fully recognized by governments, is a registered certificate of tax residency, formal and legal recognition worldwide.

The only way to process funding to projects gross rather than making those projects subject to tax is to place a specific type of plan structure between you, your business and the projects.

The money flow is described in two ways:

1) Legal Cash Flow-That is in Hong Kong which means money never goes to Hong Kong.

2) Banking Cash Flow- That is to the Custodian in the USA

Our recommendation on legal cash flows is the proposed plan administrator receive the funds directly rather than recycled through one of the client's companies because it raises additional reporting issues if we do it via a company. The legal cash flow increases yield.

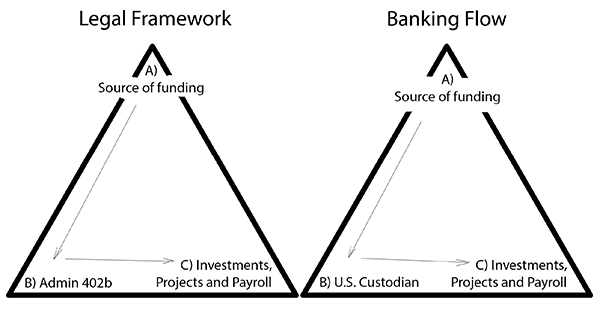

The legal flow, is a structure like a triangle, has three segregated parts:

a) In one corner is the source of funding and cash flows to

b) the Plan Administrator which flows to

c) the Investments, projects and payroll

The Banking flow, is a structure like a triangle, has three segregated parts:

a) Source of funding/client to

b) U.S. Custodian/Administrator to

c) Investments, projects and payroll

The legal flow is fundamental to your regulatory reporting and tax compliant solution because the legal ownership of projects, assets, investments, income and cash are by legal title your retirement plan.

The banking cash flow is never from the source to the project.

Therefore, the legal structure must be set-up prior to funding of projects.

The retirement plan function as sponsor and investment vehicle does not affect the client's command and control of the plan. Two separate agreements; management and ownership. The plan administrator has a legal obligation to follow the client's management. Fortified by a grant of proxy the plan administrator would necessarily refer to the client's management on voting.

How money is deployed is in three parts:

a) Capital projects

b) payroll

c) investments and accumulations

To summarize;

Description: Clean Nominee Bank Accout Occupational Retirement Plan

Purpose: Reduction in the Cost of Tax.

Function: Reporting and Tax compliance continuously

Outcome: Instead of having reduced income to invest and losing investment earnings to yearly taxation, you put one hundred percent of the income to work and compound the accumulations at the pre-tax rate of return.

The retirement plan can itself own other businesses and in addition when income from businesses owned or investments comes back into the plan it is deferred income and rolls up free of tax. Capital funding into the plan rolls up free of tax.

The Automatic Exchange of Financial Information world recognizes this cash flow is not income and deemed tax compliant.

Any money you withdraw from this plan becomes subject to tax in the year of the withdrawal; which means money re-invested within the plan is not subject to tax and that result is an increase in yield.

Yours sincerely,

Aaron