| February 28, 2017 |

| Offshore Investment Guide |

|

Hi ,

Gold is extremely rare, impossible to create out of “thin air”, easily identifiable, malleable, and it does not tarnish. By nature of these properties, gold has been highly valued throughout history for every tiny ounce of weight. That’s why it’s been used by people for centuries as a monetary metal, a symbol of wealth, and a store of value.

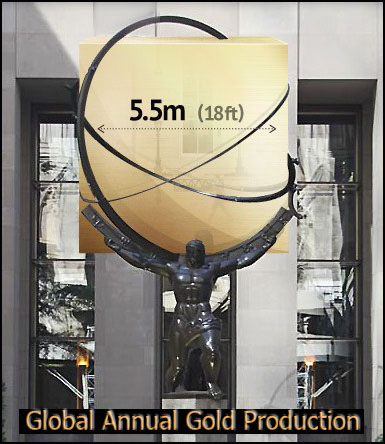

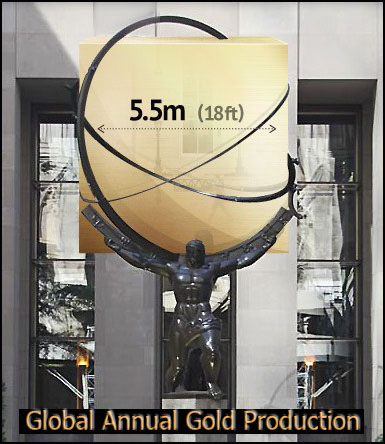

Visualizing Gold’s Value and Rarity

With all that value coming from such a small package, sometimes it is hard to put gold’s immense worth into context.

Since Ancient times, Visual Capitalist's Jeff Desjardins explains, gold has served a very unique function in society.

|

| President Trump: Replace The Dollar With Gold As The Global Currency |

John D. Mueller, of the Ethics and Public Policy Center, formerly Rep. Jack Kemp's chief economist, writing in the Wall Street Journal in Trump's Real Trade Problem Is Money recently and astutely observed:

a monetary system based on a reserve currency is unsustainable, since foreign official dollar reserves (for example) are acquired and must be repaid in goods. In other words, the increase in official dollar reserves equals the net exports of the rest of the world, which means it must also equal U.S. international payments deficits—an unsustainable situation.

In other words, if President Trump wishes to address America’s merchandise trade deficit (balanced to perfection, of course, by a capital accounts surplus) he will find that allowing the dollar to be used as the global currency is the real snake in the economic woodpile. The dollar’s burden as the international reserve currency, not currency manipulation by our trading partners or bad treaties, is the true villain in the ongoing melodrama of crummy job creation.

Mueller’s Wall Street Journal column enumerates the three options open to President Trump:

First, muddle along under the current “dollar standard,” a position supported by resigned foreigners and some nostalgic Americans—among them Bryan Riley and William Wilson at the Heritage Foundation, and James Pethokoukis at the American Enterprise Institute.

Second, turn the International Monetary Fund into a world central bank issuing paper (e.g., special drawing rights) reserves—as proposed in 1943 by Keynes, since the 1960s by Robert A. Mundell, and in 2009 by Zhou Xiaochuan, governor of the People’s Bank of China. Drawbacks: This kind of standard is highly political and the allocation of special drawing rights essentially arbitrary, since the IMF produces no goods.

Third, adopt a modernized international gold standard, as proposed in the 1960s by Rueff and in 1984 by his protégé Lewis E. Lehrman …and then-Rep. Jack Kemp.

To “muddle along” would, of course, be entirely antithetical to Trump’s promise to Make America Great Again. It would destroy his crucial commitment to get the economy growing at 3%+ -- vastly faster than it has for the past 17 years -- which also happens to be the recipe for robust job creation and upward income mobility for workers. It also is the essential ingredient for balancing the federal budget while rebuilding our infrastructure and military.

To turn the IMF into a world central bank would, of course, be anathema to Trump’s economic nationalism. To subordinate the dollar to the IMF’s SDR would be equivalent to lowering Old Glory and replacing the American flag with the flag of the United Nations on every flagpole in America. Unthinkable under a Trump administration.

That leaves the third option, to “adopt a modernized international gold standard, as proposed in the 1960s by Rueff and in 1984 by his protégé Lewis E. Lehrman … and then-Rep. Jack Kemp” (whose eponymous foundation I advise). To this one should add, as Forbes.com contributor Nathan Lewis has shrewdly observed, the removal of tax and regulatory barriers to the use of gold as currency.

As I have repeatedly observed Donald Trump shows a strong affinity for gold. He has also shown a keen intuitive grasp of how the gold standard was crucial to having made America great:

Donald Trump: “We used to have a very, very solid country because it was based on a gold standard,” he told WMUR television in New Hampshire in March last year. But he said it would be tough to bring it back because “we don’t have the gold. Other places have the gold.”

The above Wall Street Journal quotes of John D. Mueller were contained in the following Forbes article: President Trump: Replace The Dollar With Gold As The Global Currency To Make America Great Again

|

| Gold Market Speculation Strategy |

The Fixed System (option trading service) offered as follows.

All securities and cash stay with your broker or bank. We provide you with buy and sell orders. The client transmits these orders to his bank or broker for execution. Our fee is twenty-five percent of profits in excess of fifteen percent per annum.

Q: What is the Fixed System?

A: The Fixed System is the application of economic law in a manner consistent with the scientific method to profit from price changes.

Q: What do you mean by scientific method?

A: Using observation to establish facts and then logic to reach useful conclusions that follow from the factually correct premises.

Q: What do you mean by economic law?

A: A useful description of human action related to economic activity. See Human Action by Ludwig von Mises and Man, Economy, and State by Murray Rothbard.

Q: Where do I begin if I want information about how to apply economic law?

A: Start with The Art of Speculation during Civil War — Sun Tzu Meets Jesse Livermore.

Q: These three books amount to over 2,000 pages and the material is sometimes difficult. Do I need to understand all of it before I can use the Fixed System?

A: No, but you'll get better results if you do. If you want to base your speculation on facts and not falsehoods, on valid conclusions and not fallacious reasoning, then read and study these three books.

Q: Which of the three should I read first?

A: Start with the Q&A in Sun Tzu Meets Jesse Livermore (Appendix A). Then read the entire book, then Mises, and then Rothbard.

Q: I understand that all value is subjective and that in a market economy, the current price will be bid up to the expectation of future price less cost of carry. The same process occurs in reverse when market participants expect the future price to be lower. You use four criteria to measure this and to call the low in the gold market:

- a break to the downside in the general securities market

- extremely negative sentiment indicators

- ending wave pattern

- specialist short covering

Is all of this part of the Fixed System?

A: Yes. That all value is subjective is a fundamental law of economics. The system is fixed, constant, because economic law and facts are fixed, constant. You can ignore the facts and law, but you will still be subject to them and suffer the results of ignorance. Economic law is just as binding as the law of gravity.

To receive more information about the Fixed System, please Contact us today for the corresponding white paper.

|

| Invest Offshore for Deferral of Income on Gains and Accumulations |

|

There is Only One Statutory Law for Capital Deductible, Capital Raising and Provides for Deferral of Income on Gains and Accumulations:

There is no tax strategy in trust law or offshore companies

Donald Trump's Fiscal Tax Plan will increase the ultimate yield on your corporate projects and investments offshore.

Trump's plan scraps dividend tax and at the same time it scraps the foreign bank interest tax exemption. Which means, for example, bank lending overnight from the Cayman is redundant/ irrelevant. ''Tax Havens'' such as Cayman, Bermuda, BVI, Panama, Channel Islands, Ireland, Isle of Man have no future.

There is no corporate need for elaborate outside USA structures for any business, project or investment capital that were used in the past. Whether a U.S. Corp or Foreign Corp it will be tax neutral. Carrying interest by means of an offshore company is in the rear view mirror and no longer functions.

What does function is a capital deductible and capital raising deferred compensation foreign retirement plan for the foreign business.

There is no off-the-shelf product that can be purchased to achieve capital deductible and capital raising solution that we deliver for our clients. The mortar to produce the facility to corporatize your assets and investing is implemented by Fairbrook Alliance. The building blocks are registered and recognized tax compliance in occupational pension law and in inter- governmental agreements as an exempt beneficiary and excluded account.

Deferred income investing beats anyone's yield.

To receive access to your copy of the "Offshore Capital Structure White Paper" click here.

| |

|

Blog

Blog