| April 30, 2016 |

| Offshore Investment Guide |

|

Dear ,

You are cordially invited to meet us at the Seraph Summit.

IRS Compliant "On the Grid" Offshore Asset Protection Structures presented at the Seraph Summit, June 1-3 in Del Mar, California.

At the Seraph Summit they've booked an asset protection expert who they believe has the ONLY FATCA/IRS COMPLIANT ASSET PROTECTION STRUCTURE THAT IS ACTUALLY RECOGNIZED BY U.S. REGULATORS!

Here's the link for more Seraph Summit Information

|

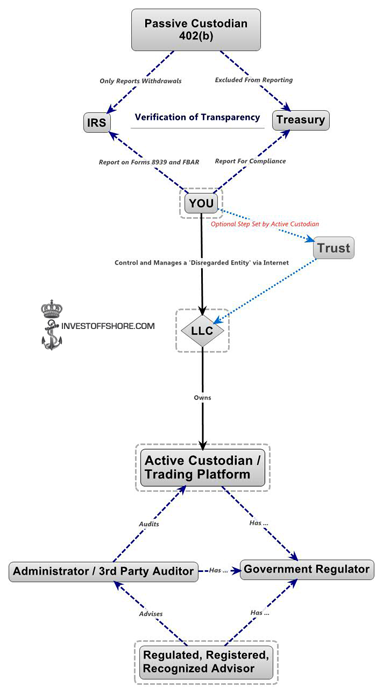

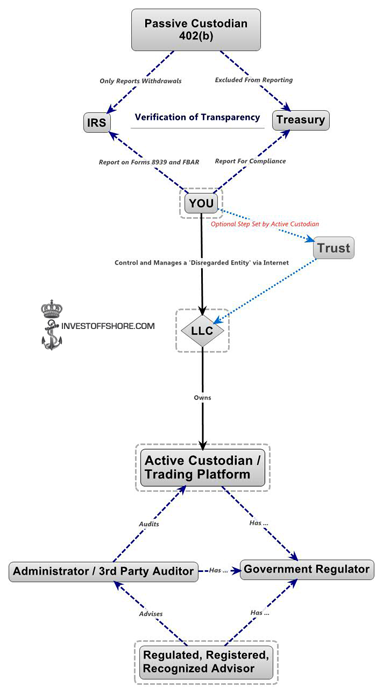

| 402(b) Mindmap (click to enlarge) |

|

Contact us today for the corresponding white paper - 402(b) and/or a free consultation.

|

| Get! - Brought to you by FATCA |

|

Be ready. Contact us today for a free copy of the book.

|

| Asset Protection Comparison Chart |

|

|

| Benefits of the 402b Structure |

402b Implementation provides:

- a foreign investment account Ordinary or Roth IRA

- access to all investment sources globally for income from capital which is the whole point and purpose of all retirement plans in perpetuity

The result of holding this specific foreign investment account is:

- no Unrelated Business Income Tax or Income (UBIT or UBTI)

- recognized exempt from tax in Common, Civil and Sharia law

The intended use of this recommendation is:

- to provide multi-jurisdictional investment choice without U.S. Person investment restrictions, restraints or blockages.

- to comply with disclosure reporting, tax compliance.

- to provide statutory asset protection acknowledged by the IRS.

When your investments are overseas via a U.S. Qualified Retirement Plan they are excluded from Passive Foreign Investment Company (PFIC) and Unrelated Business Income Tax (UBIT) rules.

A relevant foreign investment account must provide at minimum:

- Choice and control over investment class, type, currency and securities market

- No U.S. person restrictions, restraints or limitations

- Full disclosure reporting.

- Recognized asset protected by foreign domestic law, Double Tax Agreement (DTA) and Tax Information Exchange Agreement (TIEA)

- Pension law that preempts securities regulatory law

- Safety & Security in a multi-jurisdictional “Triangle of Security”

- An investment account pre-qualified as a professional investor

- Operational use to investment dealings both from inside or from outside the USA

- U.S. Person access to investing in the same manner as a tax-free foreign resident

- This puts your qualified plan assets under your control without a change in your tax consequence. and you will be able to purchase from offshore any registered, regulated and recognized security globally as a foreign investor.

Tax and regulatory protection is an ORS402(b) occupational pension which is Hong Kong Government regulated, registered and recognized by the People’s Republic of China (PRC). Contact us now about "How to move your 401k assets into an IRA offshore.

Contact us today for a free copy of the book.

| |

|

Blog

Blog