| February 28, 2014 |

| Offshore Investment Guide |

|

Hi ,

The world has turned and it is not in the same place it was in years past. Before the new international banking transparency laws were enacted (ie. FATCA, GATCA etc...) it was a right-of-passage for successful people to set-up an offshore structure in a low-tax jurisdiction, as a "nest-egg". Now all nations are sharing bank information and "nest-eggs" have turned into time-bombs, as these legacy offshore structures have major IRS reporting problems.

Please join us Saturday March 1, at 1:00 PM EST for a webinar to learn from experts about the reporting problems related to Private Placement Life Insurance (PPLI & PPVA), Offshore Trusts, Offshore IBC, LLC's and other legacy offshore structures.

|

| Offshore Investment Tax Trap |

Why you need a Regulated Assset Protection Structure?

Every day people are coming to us requesting information about setting up an operational company and holding company overseas for their business. Most of these people have never sought Legal advice because if they asked an Attorney the following questions they would learn from their answers, why they do not want a company structure!

Does an offshore business provide:

- Privacy & Confidentiality - NO

- Excluded from worldwide taxable assets - NO

- Exempt from Tax reporting on participation - NO

- Exempt from International disclosure reporting - NO

- Exempt from reporting on contributions - NO

- Protected by Double Tax Agreements & Tax Information Exchange Agreements - NO

- Has Liquidity Problems - YES

- Pre-Qualified Anti-Money Laundering and Disclosure - NO

- Preempts tax law (estate, inheritance & succession) - NO

- Subject to Probate - YES

- Avoids claims, counter-claims, discovery, dispositions, interrogatories, and potential court appearances - NO

- Irrevocable - YES

Now that you know what you don't want to do, learn more about the Regulated Asset Protection Structure (RAPS).

Offshore Investment Tax Trap Examples

Examples from a real-life case study of two actual cross border retirement planning errors. We share with you Two Tax Traps that could have been avoided if they had bolted on a specific ''RAPS''

- German Citizen, Mining Engineer, Resident Germany, is transferred to work in Peru, which he does for 8 years. In Peru his employer participated in a 401k type Peru retirement plan. He was then

transferred to work in Arizona. First time resident of USA. Of course the clock started the minute he received a USA work Visa. He got to thinking about his 200,000 USD in his Peru retirement plan so his company in Peru requested from the Peru Government that he be able to withdraw those funds without tax consequence in Peru. And the Peru Government agreed. He was obviously quite happy until he learned that the USA considered his receipt of that non-taxed retirement plan as income in the year he received it into the USA $200,000 added to that years 1040.

- US Citizen, Czech wife and they decide to retire to the Czech Republic. After becoming resident in the Czech Republic he decided to withdraw his Roth IRA funds. That withdrawal then became subject to Czech Tax on every dollar above 450,000 Czech Krone (approx 21,000 USD). Since his Roth IRA was 500,000.00 approx. He paid approx 96,000 USD in Czech Tax.

Clearly it is better to "look before you leap".

If you are interested to learn more, contact us and we'll schedule you for a free private consultation.

|

| EFG International - Structured Note |

|

2 YEARS MULTI BARRIER EXPRESS CERTIFICATE ON ISIS PHARMACEUTICALS INC, ARENA PHARMACEUTICALS INC, MERCK CO. INC., REGENERON PHARMACEUTICALS, SHIRE PLC, AEGERION PHARMACEUTICALS INC

11.52% P.A. Guaranteed Coupon - 50% Multi Barrier with Observation at Maturity Only

INVESTMENT HIGHLIGHTS

- Guaranteed Coupon of 11.52% p.a.

- Autocall Trigger Level: 90% of initial fixing

- European Barrier Level at 50% of the initial fixing

- Maturity of 2 Years maximum

- Issuer: EFG International Finance (Guernsey )Ltd.,St Peter Port, Guernsey

- Guarantor: EFG International AG, Zurich, Switzerland (FitchA/Moody's A3)

ISIN: CH0235809966

Underlyings:

- ISIS PHARMACEUTICALS INC

- ARENA PHARMACEUTICALS INC

- MERCK CO. INC.

- REGENERON PHARMACEUTICALS

- SHIRE PLC

- AEGERION PHARMACEUTICALS INC

If the worst performing underlying is above the Strike Level or is not below the Barrier, the investor will receive 100% of the denomination.

This Product is a derivative instrument. It does not qualify as unit of a collective investment scheme pursuant to art. 7 of the Swiss Federal Acton Collective Investment Schemes (CISA) and is therefore neither registered nor supervised by the Swiss Financial Market Supervisory Authority FINMA. Investors do not benefit from the specific investor protection provided under the CISA.

Request a brochure about, the structured note. |

| Algorithmic Black Box FOREX Trading |

Recommending: The ADX Linearly-Balanced to RSI Trading System named - ALBRT

The Algorithmic FOREX Server named ALBRT (ADX Linearly-Balanced to RSI Trading) is a unique "black box" FOREX trading network of proprietary hardware and software that serves second-by-second FOREX trading instructions to your own currency trading platform. This 6 year old, fully verifiable trading system, trades your account and has no authorization to withdraw or transfer your funds.

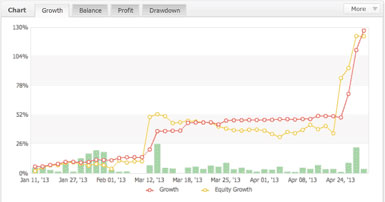

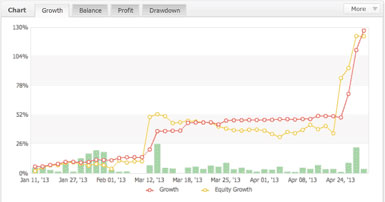

Screen shots from an actual trading account

ALBRT's algorithms are based on nine different strategic programs (eight proprietary). ALBRT systematically monitors the international currency markets, analyzes 30-years of historical data, incorporates daily charts and live dynamics, and performs thousands of calculations per second across the globe to detect 'outbreaks' in key currency pairs. When the ALBRT algorithms determine that the currency pair outbreak has ended, the server automatically instructs your platform to close positions and re-balance the portfolio.

Results vary depending on tolerance risk settings. Please contact us for actual account statements from myFXbook.

|

| Brazil Oceanfront Villa close to Rio |

Oceanfront Villa On Double Beachfront Lot $349,000

Location: Maricá - Rio de Janeiro - Brazil

Oceanfront Villa On Double Beachfront Lot $349,000

Request more information about Brazil properties. |

| Euro Pacific Bank Ltd. |

|

Founded by internationally renowned investor and best-selling author Peter Schiff, Euro Pacific Bank offers clients an unparalleled

offshore banking experience. Superior customer service and innovative non-lending, hard-money approach differentiates EPB in

the offshore banking world.

| |

|

Home Page

Home Page