| April 6, 2013 |

| Offshore Investment Guide |

|

Hi ,

This week, the Washington, DC-based International Consortium of Investigative Journalists released a series of stories based on 2.5 million documents. In the last 15 months, 86 journalists in 46 countries have been poring over the document cache. What makes this offshore tax haven exposé such a blockbuster, however, is that it names names, in effect puncturing huge holes in the armor of secrecy that makes offshore havens so attractive. These reports expose an array of individuals, including politicians (everyone from a Kuwaiti sheikh to Imee Marcos in the Philippines to members of the Azerbaijani ruling family), businessmen, criminals, and even a songwriter and art collector who have stashed their assets overseas.

What the reports fail to point-out, is that it still makes perfect sense to incorporate offshore and the #1 reason anyone/everyone who can afford to invest offshore should do the same as the 130,000 people who were exposed, is a simple answer: ASSET PROTECTION.

Aaron A Day

|

| The Specter of Things to Come |

| By Theodore (Ty) Andros

The road to ruin is on plain display and the playbook is easily seen at this juncture. Let's take a look at how things will unfold. Contrary to popular outrage of the solution being imposed in Cyprus, it is the correct one once the insured depositors were protected. In this situation the elites suffered first followed by the private sector depositors who foolishly believed false balance sheets which were Politically correct but practically incorrect fictions approved by the fiduciary (regulations and regulators allowed ongoing insolvent operations rather than protect the public by ending and prohibiting them) challenged governments (work for the banks and crony capitalists not for the public at large).

The pecking order of the losses was the correct one: Shareholders first, bondholder's second and lastly uninsured depositors. Have we seen this anytime since the crisis began? It is clear that this is and what must be what's done in the future. But for the countries in question to recover they must recover the ability to print and devalue their currency to competitiveness.

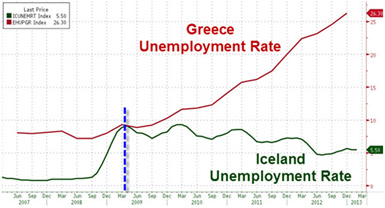

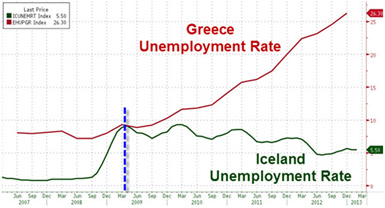

Ask Iceland and Greece how the different paths turn out? Iceland (wiped out bond holders, shareholders, prosecuted the banksters and devalued its currency and is in RECOVERY mode), versus Greece (where the Troika holds all the debt, refuses to take a haircut, the bank shareholders and current bondholders (TROIKA) are intact, is forcing INTERNAL devaluations (to get their new slaves in line) rather than external and is in a perpetual DEPRESSION).

Which country would you choose to be in? One is internally devaluing (Greece) and Iceland externally. In Greece the future is BLEAK, in Iceland freedom and a good future only requires hard work and REAL wealth creation for the public at large. Italy, Spain, Portugal, Cypress, Ireland are internally devaluing and firmly on the road to ruin. France is up next.

This is why the euro is DOOMED as internal devaluations destroy many generations of citizens and allow unelected technocrats to gather POWER over all. Whereas external devaluations provide the path to recovery. Beppo Grillo is a hero to those who want a future and their freedom from the debt slave masters in Brussels, the IMF, BIS and European central bank.

In a rare moment of candor the Head of the Eurogroup of finance ministers spoke the truth: "If there is a risk in a bank, our first question should be: 'Ok, what are you the bank going to do about that? What can you do to recapitalize yourself?' If the bank can't do it, then we'll talk to the shareholders and the bondholders. We'll ask them to contribute in recapitalizing the bank. And if necessary the uninsured deposit holders.

- Dutch Finance Minister Jeroen Dijsselbloem, who heads the Eurogroup of euro zone finance ministers

Unfortunately the vast majority of banks in the Eurozone will CEASE to EXIST inside this TEMPLATE. This statement reflects reality and is practically correct but is politically incorrect. He quickly retreated to the standard of LYING after the proper amount of PRESSURE from Brussels was applied.

It is THE template and since the sovereigns in which these insolvent banks reside are ALSO insolvent themselves a belly button moment is at hand for the European central bank and the European commission in Brussels. CLOSE DOWN HALF of the banks (or more) within the Eurozone, stockholders, liquidate bomb...er...bond holders and confiscate the rest from uninsured depositors or get the printing press in HIGH GEAR!

--- Continue reading The Specter of Things to Come

|

| Ten Reasons to get Loaded on Alcohol Stocks |

|

When we face difficult time we drink to forget, when times are good we drink to celebrate. Alcohol consumption is a growing part of our life. According to the World Health Organization, (WHO) the adult population drank the equivalent of 6.1 liters of pure alcohol per person in 2005. Sadly, we couldn't find more recent statistics, but the earnings of the global sectors seem to indicate that consumption is increasing. The WHO numbers support my allegation of growth in consumption as their study shows that over a five years period, for every individual who reduced his alcohol consumption, 14.69 people increased it. We have a strong conviction that the trends in earnings growth will continue for the years to come and here are ten reasons why you should load on the sectors. When we face difficult time we drink to forget, when times are good we drink to celebrate. Alcohol consumption is a growing part of our life. According to the World Health Organization, (WHO) the adult population drank the equivalent of 6.1 liters of pure alcohol per person in 2005. Sadly, we couldn't find more recent statistics, but the earnings of the global sectors seem to indicate that consumption is increasing. The WHO numbers support my allegation of growth in consumption as their study shows that over a five years period, for every individual who reduced his alcohol consumption, 14.69 people increased it. We have a strong conviction that the trends in earnings growth will continue for the years to come and here are ten reasons why you should load on the sectors.

- The Global population is expanding rapidly, for every death, we have 2 births and therefore, the amount of consumers continues to expand.

- WHO research is indicating that the population wealth directly affect consumption, the wealthiest nations consuming 10.55 liter of alcohol per year when the poor one only drink 2.97 liter. As the middle class expands, in particular in the BRIC countries, consumption per capita is expected to expand as well.

- Alcohol is now socially accepted in most countries outside of Islamic regions. When is the last time you went for diner without bringing a bottle of wine to your guest? Those trends take generations to form and more generations to fade away. Beer, wine and spirits are now at the center of any gathering, from birthday to funeral. Sport evens, religious celebrations or art performance all translate into a "let's drink to that"

- Governments derive an important source of revenue from taxation on alcohol sales. We should note that the long-term effect of important alcohol consumption may proof to be more costly in healthcare services then the taxes generated. However, in a tax craving society, where level of Sovereign debts has passed 50 Trillions, don't expect governments to drop short-term income for the well being of the population long term. I expect taxes on alcoholic beverages to continue to increase but I don't expect any type of push to reduce consumption.

- Except for a really short period of time in 2008, most if not all alcohol related corporations have outperformed the SP500 during the last five years. This is not difficult to understand, consumption increase in good and difficult times, therefore, we should expect the sector to do better in bear or bull market.

- Alcohol stocks present a growth opportunity as consumption increases. However, we also consider alcohol equity as a defensive play within the portfolio, the reason being that they are much more a consumer staple then a consumer. How many times would the average family choose beer over bread when money is scarce?

- The entire sector is in a major consolidation mode. Diageo (DEO) acquisitions of Mrey Icki in Turkey and United Spirits in India over the last two years or the recent interest from AB Inbev (BUD) to acquire Groupo Modelo (GPMCF) are example of how dynamic the sector is becoming. Our view is that large and well-established corporations will continue to capture emerging countries marketshare through acquisition over the next five years. This will be supportive of prices. All of those acquisitions will translate into important economies of scale that will positively impact bottom line.

- The difference between Alcohol stocks provide opportunity for a tactical allocation. In difficult time, move capital toward the cheaper brands such as AB Inbev (BUD) and in time of prosperity, favor higher end products such as Diageo (DEO) or Boston Berr co (SAM).

- Research tend to demonstrate that a daily moderate consummation of alcohol increase the quality and the duration of life.

- The most obvious and sad part of the story is that Alcohol is an addictive substance and consumption increases should translate to even more consumption in the future.

My goal here is not to persuade anybody to hit the bar for a drink or two tonight. We need to remember that alcohol is responsible for 4% of deaths worldwide. It has destroyed many lives and alcoholism has now reach epidemic proportions in countries such as Russia. My point is that, like it or not, alcohol consumption is increasing worldwide. This trend should accelerate as emerging markets increase their population and their discretionary spending. As an investor, you can participate in this growth.

At this stage we would recommend to buy Companhia de Bebidas das Americas (ABV) on a pull back. ABV presents a P/E ratio slightly higher than its competitors, easily justifiable by its future growth prospect. Remember that Brazil has the fifth largest population in the world and will welcome the World Cup and the Olympic games in the coming years. We also like ABV parent company,Anheuser-Busch InBev (BUD) and the premium beer producer Boston Beer Co (SAM). For a list of listed alcohol corporations click here.

Clover's clients are long ABV, BUD and SAM.

For more information on how Clover Asset Management can help grow your wealth please contact us at +1 (345)743-6639 or email us at forwardthinking@clover.ky

|

| 100% Capital Protected Deposit - Global Large Cap 1 |

|

For Professional Investors Only

Key Features

Investment linked to a basket of European large cap stocks, providing the opportunity for annual returns of up to 5.00% over the first 4 years and exposure to the performance of the underlying stocks at the end of year 5. The investment is 100% capital protected at the Account Closing Date.

Investment Description

- The Nomura Global Large Cap 1 ("the Deposit") is linked to a basket of Global large cap stocks

- The Deposit provides investors with the potential for returns of 5.00% for each of the first 4 years, combined with participation in the performance of the underlying stocks at the Final Valuation Date.

- The Deposit taker is Nomura Bank International plc ("the Deposit Taker"), which is rated by S&P as A-, at the time of a publication

- The Deposit is available in USD, GBP and has an investment term of 5 years, and is intended to be held for the entire period

- The 100% Capital Protection only applies at Maturity (the Account Closing Date)

NOTE: closing May 3, 2013

Issuer: Nomura Bank International plc (NBI), rated as A- by S&P

- A 5 year investment linked to the performance of the stocks of Novartis, Swisscom AG, Deutsche Telekom AG, Astra Zeneca plc. and Total SA.

- Your initial investment is made at a price of 100%, and there is potential following each of the 4 annual Conditional Coupon Observation Dates to receive a 5% coupon

- In addition to the potential for income, at the end of year 5, the investor will participate in the performance of the Worst Performing Asset. For example if Novartis AG has returned +20% over the 5 year period and is the Worst Performing Asset, the investor will receive back 120% of their invested capital

- In the worst case scenario at maturity, if all of the Underlying Assets have performed negatively. The investor will have 100% of capital invested returned at the 5 year Account Closing Date

Underlying Assets:

- Novartis AG (NOVN VX Equity)

- Total SA (FP FP Equity)

- Astra Zeneca (AZN LN Equity)

- Deutsche Telekom (DTE GY Equity)

- Swisscom (SCMN VX Equity)

Conditional Coupon

- Conditional Coupon Amount - 5%

- Following each Conditional Coupon Observation Date, if the price of each underlying is greater than or equal to 105% of its Initial Valuation Level the Deposit will pay a coupon of 5.00%

- Redemption Value - 100% + Performance of the Worst Performing Asset

(subject to minimum value of 100%)

Product Reference: Global Large Cap 1 USD Deposit - Global Large Cap 1 GBP Deposit

Risk Disclaimer: Please bear in mind that investors are exposed to the credit risk of the Deposit taker. Any secondary market provided by Nomura International plc is subject to change and may be stopped without notice and investors may therefore be unable to redeem the Deposit until its maturity. If the Deposit is redeemed early it may be redeemed at a level less than the amount originally invested.

The NOMURA Global Large Cap 1 brochure, available upon request.

|

| Amazing Oceanview Villa For Sale

|

Maricá - Rio de Janeiro - Brazil

3 Bedroom 4 bath Oceanview Villa For Sale: $229,000

Ponta Negra, a peaceful tranquil area just a short distance from the city of Rio, where people are polite, friendly, and crime is virtually unheard of.

- 3 Bedrooms

- 4 Full Bathrooms

- Air Conditioning

- Pool

- Sauna

- Kitchen

- Separate Caretaker House With Caretaker In place

- Fantastic Balcony Off Each Bedroom

Request more information about Brazil properties.

|

| Offshore Gold Storage |

|

You can store your metals with:

- VIA MAT - in vaults in Hong Kong, Switzerland and the UK.

- Brink's - in vaults in Toronto and Singapore.

- Rhenus - in a vault at Zurich Airport in Switzerland.

- G4S - in a vault in Hong Kong.

Ready to invest offshore in precious metals? click here

| |

|

When we face difficult time we drink to forget, when times are good we drink to celebrate. Alcohol consumption is a growing part of our life. According to the World Health Organization, (WHO) the adult population drank the equivalent of 6.1 liters of pure alcohol per person in 2005. Sadly, we couldn't find more recent statistics, but the earnings of the global sectors seem to indicate that consumption is increasing. The WHO numbers support my allegation of growth in consumption as their study shows that over a five years period, for every individual who reduced his alcohol consumption, 14.69 people increased it. We have a strong conviction that the trends in earnings growth will continue for the years to come and here are ten reasons why you should load on the sectors.

When we face difficult time we drink to forget, when times are good we drink to celebrate. Alcohol consumption is a growing part of our life. According to the World Health Organization, (WHO) the adult population drank the equivalent of 6.1 liters of pure alcohol per person in 2005. Sadly, we couldn't find more recent statistics, but the earnings of the global sectors seem to indicate that consumption is increasing. The WHO numbers support my allegation of growth in consumption as their study shows that over a five years period, for every individual who reduced his alcohol consumption, 14.69 people increased it. We have a strong conviction that the trends in earnings growth will continue for the years to come and here are ten reasons why you should load on the sectors.

Home Page

Home Page