| March 15, 2013 |

| Offshore Investment Guide |

|

Hi ,

When asked what makes our Regulator Asset Protection Structure (RAPS) unique and better? We answer with the following: It's the Alternative to Irrevocable Trusts.

The Alternative to Fraudulent Conveyances. The Alternative to FLP, LLC, IBC and Foundations. The Alternative to Annuities. The Alternatives to an Insurance Company intermediary! The Alternatives to Litigation. The Alternative to Lengthy Tax Filings. The Alternative to the S.E.C.

Ultimately, RAPS is a smart alternative way to invest offshore.

Aaron A Day

|

| Invest Offshore with the "One World" Employee Benefit Retirement Plan |

| Solution to Reporting and Holding Income and Gains Tax Deferred

Introducing the Adviser to the Government Regulated, Registered, Recognized Retirement Plan Trustee and to the Plan Administrator.

Your Employee Retirement Plan will have a Government Regulated Trustee and Plan Administrator, Registered in the E.U. and is Tax

Recognized in the USA, Canada, U.K., E.U, EAA and in most of Asia. Your Employee Retirement Plan is a non-pooling Multi-Employer

Master Trust/Employee Retirement Plan registered in the E.U.. The Retirement Plan Regulator is a member of the International Organization

of Pension Supervisors (60 Country Members).

Your Employee Retirement Plan is for "World Citizens" and for Foreign employees in search of Tax Compliance and

Simplified Tax filing that is tax complaint in 60+ Countries and has legal statutory tax compliance to requirements of their home

Country (i.e. USA, Canada, U.K., Australia, New Zealand and many others).

The Adviser also fulfills an on going role with each client in providing annual reviews and will continue to oversee the legal structure

of each Employee's Retirement Plan from a tax-compliance standpoint in his current country of residents and his own Nationality.

We also maintain global reach and local insight in regards to any applicable Government Tax Rulings, Tax reporting, account ownership

and/or vesting issues on a client by client basis.

Keeping Multi-Jurisdictional, tax treaty network, and domestic tax law issues in mind ensures your ISP Retirement Plan has Global

Reach and Domestic Tax compliance for each employee.

The Adviser continuously evaluates alternative Cross Borders Tax Compliant Financial Solutions accessed by means of Government

Regulated, Registered, Recognized International Retirement Plans. We interface with Banks, Brokers, Attorney's, Accountants,

Asset Managers, Registered Investments, Trustee and other Financial Service providers in order to tailor each Employee's

Retirement Plan with access to internationally recognized and government registered investment choice to match each members

own criteria.

They also source an integrated package of wealth management services to be held within each employee's Retirement Plan.

Your Retirement Plan provides "Red Carpet" access to the Worlds Top Flight Investments, Investment Advisers and Wealth Management

Specialists.

The Retirement Plan Investment Account Custodian provides Separate Member Accounts which are portable and driven by the

Employee by means of On-Line access. This means that each employee's plan can be maintained independently and continuously

regardless of his future employer or country of residents.

You are assured that wherever in the world your employee lives, works, and saves for Retirement that your Advisor has the

global resource network with the experience to speak Retirement Planning in your Employee's own language.

This Cross Borders Retirement Plan is Regulated by a member of the International Organization of Pension Supervisors.

Employer Benefits are:

- No Liability

- No Administration

- Tax Neutral

- Recruiting Advantage

- Employee Retention Advantage

- Safety and Security

Employee Benefits are:

- Tax-Free or Tax Deferred investment income and gain

- Tax-Free distribution to members in USA, Canada, E.U. , U.K. and Asia

- Self Driven and Portable

- Economical way to save for Retirement

- Retirement Benefits

- Safety and Security

For a more information about the Cross Borders Retirement Plan contact us today.

|

| From the Farm to your Wallet! |

|

Over the last few weeks we've published a series of articles to help investors understand what will be the primary global economic drivers for the next ten years. These three drivers were:

Now that we have set the table lets see which investment's can profit the most from these drivers. In the forthcoming columns I will present ten investment themes that will profit from the demographic, economic and political situation we will face over the next ten years.

Investment Theme 1: Agribusiness

"No society is more than three meals away from revolution."

Arnold Reimer

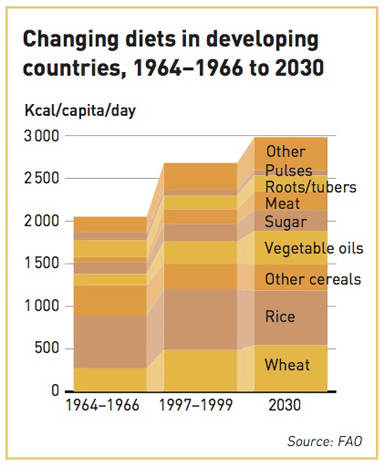

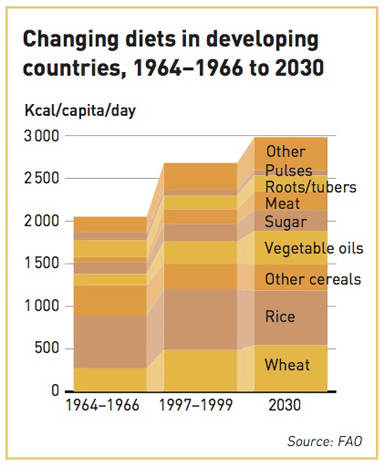

We have strong expectations in the Agribusiness sector, especially when it comes to food producers. Firstly, it is important to realize that food is a commodity. As a matter of fact it is the ultimate commodity as it is essential for the survival of our species. Like all commodities, the price of food will vary in response to supply and demand. We can simplify this further by stating that supply is a question of hectares harvested and weather conditions and demand is above all a question of population growth. We saw a few weeks ago that world population is growing rapidly and is expected to increase by 30% in the next 25 years. It is not necessary to be a Nobel Prize winner in Economics to expect demand for food to continue to increase in the coming years. Food demand is expected to surge in all categories. (Fig 1)

Fig 1

We know about population growth expectations therefore the question becomes "will supply be able to cope with the increase in demand"?

According to research from FAO (Food and Agriculture Organization of the United Nations) the simple answer is yes. "Detailed analysis shows that, globally, there is enough land, soil and water, and enough potential for further growth in yields, to make the necessary production feasible. Yield growth will be slower than in the past, but at the global level this is not necessarily cause for alarm because slower growth in production is needed in the future than in the past. However, the feasible can only become the actual if the policy environment is favorable towards agriculture."

I would agree that in a perfect world we could feed our growing population without supply constrains. Note that I use the phrase 'a perfect world', where government budgets would be balanced and the world would live in peace...however the world is far from being perfect. We see multiple risks ahead that will affect the cost and the production of agriculture goods. These include; climate change, deforestation, declining oil reserves, species extinction, water shortage, land exhaustion, pollution and the growing demands for a higher calorific diet from emerging markets.

We put the probability of seeing the environment for agriculture continuing to deteriorate going forward at close to 100%. We should, therefore, expect food inflation to accelerate in the future. Food inflation is the core reason we see Agricultural corporations and their providers as a great investment for the years to come. Either they will grow like the rest of the economy or there is a shortage in supply and prices will increase much faster than other sectors.

We consider the entire food chain as a lucrative investment, from farms to restaurants. Nevertheless we recommend staying closer to the beginning of the food chain. Our research indicates that when inflation picks up farmers will be better positioned to increase their prices and pass it forward. The grocery store or the restaurant may not be as lucky and may experience margin squeeze. The market collapse of Chipotle Mexican Grill (CGM) in 2012 is a good example of this. Great brand, great meals and great management, however there is a limit to how much people will pay for a burrito. When the price of pork and rice increased, CGM's margins got squeezed and we saw the stock's price drop by close to 50%. Conclusion: the closer to the ground, the better.

For investors looking for growth without excessive volatility the best approach to the Agribusiness would be to participate through an ETF. We particularly like the Market Vectors-Agribusiness ETF (MOO) and the PowerShares DB Agriculture Fund (DBA).

MOO is a global ETF which holds 51 positions, presents a four stars Morningstar rating and is geographically well diversified. DBA invests directly in food commodities through futures providing investors with a basket of 11 different commodities - from Cattle to Wheat.

For the investors looking for higher returns and who can stomach more volatility, we specifically like Adecoagro S.A., (Agro). Agro is a pure farming play, the corporation owns and operates more than 40 different farming assets throughout Argentina, Brazil and Uruguay. It is a small cap with high volatility and we should note that it is down 12% since becoming public in January 2011. The depreciation of the Real in Brazil and the political situation in Argentina have hurt the company's value but we remain confident that this farming conglomerate will deliver great value overtime, especially if you purchase the stock below $8.00 per share.

The Agribusiness presents a great risk reward profile going forward; you will either get market return if FAO is right or much better if supply can't cope with the demand as we predict.

Next theme: Technology

For more information on how Clover Asset Management can help grow your wealth please contact us at +1 (345)743-6639 or email us at forwardthinking@clover.ky

|

| RBC World Banks Phoenix Autocall Notes |

|

Investment Description Investment Description

An investment combining the potential for Annualised Returns of up to 13.4%, potential market triggered redemption every 3 months, and linked to a selection of Financial Stocks. If ALL Underlyings are at or above 75% of their initial level on each Quarterly Observation Date, then the investor receives a 3.35% Bonus Payment.

NOTE: closing April 11, 2013

Issuer: Royal Bank of Canada, one of the highest rated financial institutions in the world (AA- rated)

Key Features

- 19 opportunities for market linked early redemption, every 3 months (100% trigger)

- Potential for returns (up to 13.4% p.a.), in exchange for a defined level of risk -max return 67% over 5 Years.

- Potential income of 3.35% Quarterly, paid as long as ALL Underlyings are at or above 75% of Initial Valuation Levels, observed on each Quarterly Observation Date

- Defensive outlook -strong capital buffer, no loss of capital as long as no Underlying has fallen below 50% of its Initial Valuation Level (European Barrier).

Underlyings:('Stocks')

- MORGAN STANLEY (MS UN Equity),

- DEUTSCHE BANK AG (DBK GY Equity),

- BANK OF AMERICA CORP (BAC UN Equity),

- ING GROEP NV (INGA NA Equity),

- SOCIETE GENERALE (GLE FP Equity)

Key Dates

- Initial Valuation Date: 04 April 2013

- Issue Date: 11 April 2013

- Final Valuation Date: 04 April 2018

- Maturity Date: 11 April 2018

ISIN Codes

- GBP: XS0904827697

- USD: XS0904826459

- EUR: XS0904827002

The Notes are available in USD, EUR and GBP

For Professional Investors Only

Risk Disclaimer: Please bear in mind that investors are exposed to the credit risk of the Issuer. The Notes are not capital protected and investors may receive back less than the original amount invested. The value of the investment can go down as well as up and investors can potentially lose all of their investment. Any secondary market provided by Royal Bank of Canada is subject to change and may be stopped without notice and investors may therefore be unable to sell or redeem

the Notes until their maturity. If the Notes are redeemed early they may be redeemed at a level less than the amount originally invested.

Royal Bank of Canada - US Financials Income Note brochure, available upon request.

|

| Beach Home in Gated Community

|

Cabo Frio - Rio de Janeiro - Brazil - $349,000

Cabo Frio Beach Home In Gated Neighborhood

Location: Cabo Frio - Rio de Janeiro - Brazil

To see more photos and information click here.

Request more information about Brazil properties.

|

| Offshore Gold Storage |

|

You can store your metals with:

- VIA MAT - in vaults in Hong Kong, Switzerland and the UK.

- Brink's - in vaults in Toronto and Singapore.

- Rhenus - in a vault at Zurich Airport in Switzerland.

- G4S - in a vault in Hong Kong.

Ready to invest offshore in precious metals? click here

| |

|

Investment Description

Investment Description

Home Page

Home Page