The Regulatory Landscape

Over the last 10 years, governments have introduced a number of new initiatives to clamp down on tax enforcement. The Savings Tax Directive, Article 8 of the Administrative Cooperation and Mutual Assistance Directive of 2011 in the EU, for example, is to be enacted in 2014 and expanded in 2017. The impact of this legislation is to close down traditional offshore financial centers, or so-called "tax havens."

In recent years, UK, France, Spain and Portugal have concluded hundreds of Tax Information Exchange Agreements (TIEAs) with traditional offshore financial centers. The UK has been significantly active, introducing information disclosure facilities with Lichtenstein, Switzerland, Channel Islands and Isle of Man. The US has introduced the Foreign Account Tax Compliance Act (FATCA) and the G5 is now preparing similar multilateral information sharing structures. There is no reason to believe that this approach will not become a global phenomenon.

Tax Information Exchange Agreements worldwide have changed the financial and tax environment for Everyone working, living, or investing abroad. These changes cannot be ignored. As a result many old and new rules regarding assets held by employees outside their country of resident are enforced to a far great degree than they ever have been before. Tax authorities, for the first time, will have easy access to information about these assets. The good news is that these changes will prompt many to take steps now that address these new concerns.

Expats and retirement

Compensation has evolved substantially over the years, with the focus shifting away from relocation allowances to global special benefits. As pension debates in many countries bring retirement planning to the fore, employer-sponsored retirement benefits are often seen as key in a competitive remuneration program. Many mobile employees do not remain long enough in a given location to build an old-age retirement benefit under the local rules, and local social legislation and related tax regimes often complicate their participation in locally organized retirement plans.

An Employer's Top Strategic Business Issue: 2012 Deloitte ''Strategic Moves...Global Mobility '' Survey.

''Nearly 50% of all organizations surveyed agreed that their top strategic business issue is ''emerging geographical markets''... Three-Quarters (75%) of participating companies anticipate that the total number of quality mobile employees (permanent transfers, local hires, global nomads) will increase or increase significantly over the next three to five years... Nearly 80% anticipate that global mobility will become more important or significantly more important over the same period.''

In general, participation in an IRP is reserved for those employees who are either highly mobile -- the true global nomads -- and for those permanent transferees for whom the local provisions in the host country are not sufficient or possible.

The most common desire with mobile employees is to maintain their active membership in the retirement program of their home country while they are relocated. But when tax or legal matters make such a solution sub-optimal or even impossible, a move to the retirement arrangement established in the host country is another solution. The first option may be appropriate for employees on short-term assignments, while the second might be recommended for long-term assignees or employees who permanently relocate. However, for some mobile employees, neither of these options may work, as the move from country to country for short amounts of time may not always let them meet all vesting and participation requirements. Additionally for high income earners the local plans do not allow for adequate funding. What's more, the payout of benefits when retiring abroad may not occur in a tax-efficient manner.

The Basics of International Retirement Planning

First, we determine which is the best legal framework in the whole world and we do not assume that because you have a company registered in one jurisdiction that it would be that country's law applying to the retirement fund and why should we, because it is not logical to have the legal framework of your retirement plan coinciding with the place where the company is registered, it sounds logical but actually in the future, modern world it is not. Because to chose the legal framework on the basis of your company registration would be constraining you and automatically the law on pensions and retirement plans is radically different than the law on corporations and trading, of course it is different and therefore we do not make this assumption when recommending a particular country plan.

Second, it is also imperative to look at where is the best place for your custodian. U.S. Centric people would make an assumption automatically, which explains how illogical some peoples thinking is, that if you have a foreign retirement plan in USD that naturally the custodian will be in New York. The legal framework should be one thing, the custodian another. There is nothing wrong with having the custodian in New York but the point is that one needs to think about where one wants to have that custodian in the first place. And can that custodian do the best job? While you can have a 402(b) foreign plan with a foreign custodian, you can also have a custodian in the USA.

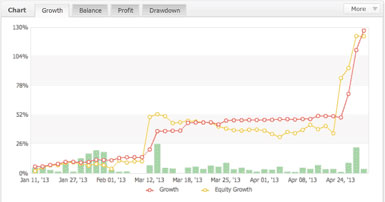

The Third consideration is actually the whole point behind a foreign retirement fund which is to allow you to accumulate your deferred income clear of taxation because it turbo-charges your funds future value. Tax utilization for gain is the whole point and purpose of all retirement plans in perpetuity. This is a win/win because you pay more total tax in the future and your net amount gain is higher than if you had paid tax annually. This structure is designed to last and therefore is the future of retirement law- where is best, who has the money and has turbo-charge its growth by means of tax deferral.

An ''International Retirement Plan'' may help solve the challenges of these globally mobile employees. Of course, due to the absence of fiscal incentives and sometimes even the ability to deduct contributions, these plans may be more expensive than local supplemental plans. Therefore it is important to clearly define the target group and to lay out a consistent retirement strategy for your mobile employees.

Inclusion of US taxpayers

Because US citizens and US tax residents are being taxed on their worldwide income, additional reporting requirements apply to these employees. As a result, the IRP solution must provide for simplified tax reporting. The selected IRP must be one that requires the individual to file FBAR and IRS 8938 only and for the Employer to have no reporting requirement.

The past global trend has been that Insurance or Trust based plans were set up as defined contribution savings plans financed and administered through either an insurance or trust arrangement. However, these plans are difficult or even not possible to adapt for U.S. connected persons (US persons, US residents, US Aliens, and Green Card or Professional US work Visa holders worldwide)

Because IRPs are non-qualified plans and are not subject to any social legislation in the countries where they're established, employers can set their own criteria for eligibility and contributions within the often very wide framework provided by the diverse vendors.

A Foreign IRP can provide the broadest and deepest registered investment choice globally without restrictive regulation. Both US domestic and foreign securities are available because US Passive Foreign Investment Company (PFIC) rules are irrelevant and there are no US Securities and Exchange Commission(S.E.C.) restrictions. International wealth management requires global flexibility in investment choice, class and currency. Any structure should provide for separation of trustee, investment account and custodian.

If you are interested to learn more, contact us and we'll schedule you for a free private consultation.

|

Home Page

Home Page