| March 1, 2013 |

| Offshore Investment Guide |

|

Hi ,

The main goal of any asset protection plan is to protect yourself from liability, preferably in a manner that's timely and totally tax-compliant to avoid any last ditch effort to "hide" assets while maintaining a modicum of confidentiality - not secrecy.

Make sure you have a solid plan in place tailored to meet your personal needs and an amount of asset protection you are comfortable with. Contact us today to learn how.

Aaron A Day

|

| PFIC Problem for Americans with offshore investments |

| True case study

WARNING: U.S. Persons who are holding a Life Policy (lump sum or savings plan) from the Isle of Man, Ireland, Guernsey, and Jersey are subject to annual taxes on the growth of 36.9% and huge annual penalties if not reported. The "U.K. Style Financial Advisor who sold hundreds of thousands of these products had their clients sign a disclaimer that it is not a IRC 7702 or IRC 72 - However, they did not tell the customers WHAT IT IS!"

If you have one it is called a PFIC and the THE PROBLEM is that the Isle of Man, Ireland, Guernsey, and Jersey and all of the United Kingdom have signed an agreement to notify the IRS of all their U.S. clients and quite frankly the IRS knows what a U.K. Style 101% policy is; British IFA Offshore Investment Products.

It is a PFIC if:

- IF the client has not annually reported his PFIC to the U.S. Treasury the penalty is $50,000 USD Annually

- IF the client has not annually reported his PFIC to the IRS from 2011 the penalty is $10,000 USD Annually.

- If the client has reported it then he has taxes due annually of 36.9% of the growth and if he has not paid that tax

- he will have penalties and interest charges until he has paid it.

The IRS pays a whistle blower a 30% commission on their collection.

Tax Requirements for U.S. Insurance Contracts

If you are an American, you are taxed on your worldwide income and assets. No surprise! The surprise comes when you find out that the IRC Sec 7702 has a very precise definition of a life insurance contract for tax purposes. When a life insurance contract violates this provision, IRC Sec 7702(g) dictates how the policyholder will be taxed. Guess what? These policies violate the U.S. definition of life insurance.

In a nutshell, a violation results in the policyholder being taxed on the investment income within the policy in the year the contract fails the U.S. tax law definition of life insurance. The policyholder is also taxable on the cost of insurance associated with the mortality component of the policy.

If a policy has been non-compliant for U.S. purposes for ten years, technically all of the investment gain within the policy would become taxable immediately along with the cost of insurance component during that time frame. Variable annuity contracts also have a specific definition within the Internal Revenue Code, IRC Sec 72. Additionally, variable life insurance and annuities also must also comply with the rules for variable insurance products found in IRC Sec 817(h) and Treasury Regulation 1.817-5.

An important component of these rules is the requirement that the investment funds must be exclusively available to the policyholders of the insurance company and not include non-insurance investors. In my experience, every non-U.S. variable life or annuity policy or unit linked policy would fail to meet the requirements of IRC Sec 817(h) as well as IRC Sec 7702 or IRC Sec 72. The majority of tax treaties dealing with annuity provisions provides for no taxed on annuity income in the Host Country and only in the Home Country.

Unfortunately, the U.S. tax rules would cause the American owning the foreign life insurance or deferred annuity contract to be taxed currently.

SOLUTION: U.S. Persons who are holding a Life Policy (lump sum or savings plan) from the Isle of Man, Ireland, Guernsey, and Jersey are advised to contact us today for a free no-obligation consultation about how to fix the PFIC problem.

|

| $50 Trillion in Debts... How Far Can We Go? |

The fact that we are here today to debate raising America's debt limit is a sign of leadership failure. America has a debt problem and a failure of leadership. American's deserve better. I, therefore, intend to oppose the effort to increase America's debt.

~ Barack Obama, March 16, 2006

The more things change, the more they stay the same. Almost all countries are now presenting budget deficits and this five years after the global financial crisis. Where are the surpluses to be enjoyed after the orgies of spending and money printing? As I am writing these lines the global debt clock from economist.com has just crossed the USD50 trillion mark. The accumulation of all these deficits is pushing the debt level of many countries to breaking point. The phenomenon has reached a global epidemic and the debt cancer is now devastating all continents.

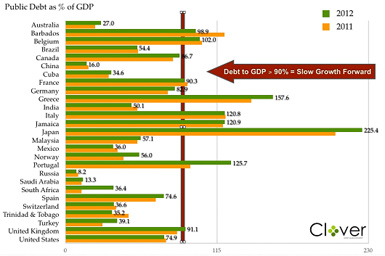

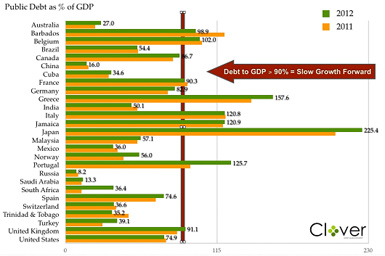

Lets take a look at public debt as a % of GDP for 2011 and 2012 to show an important sample of the world economies (Fig 1)

Fig 1 Public debt as a % of GDP for 2011, 2012 source: economist.com

As we can see, the liabilities situation degraded for many in 2012. As a matter of fact several countries, presenting some of the highest Debt/GDP ratio in 2011, found ways to make the situation even worse in 2012. Greece, Japan and Portugal all saw their ratios increase drastically. Many countries have passed the point of no return. A study by Reinhart/Rogoff suggests that economic growth begins to suffer when a country's debt-to-GDP ratio exceeds 90%. As the servicing of the debt takes its toll countries become ill equipped to deal with future recessions and rapidly fall into a debt inflation spiral. Countries with high debt level are faced with the choice of either increasing their debts to try to stimulate their economy and to reflate their GDP or cutting spending to reduce the debt to the detriment of their GDP. Short term both scenarios bring the same result, a higher Debt/GDP ratio. Long term there are no guarantees that the situation will get better. Simply put, when Sovereign debt becomes unmanageable countries are faced with one or all of the followings:

- Currency Devaluation

- High Inflation

- Default

High level of debts can be addressed. Canada was able to tackle it's problems with some drastic cuts in spending and a major devaluation of its currency in the nineties. (see 6 reasons to buy Canada). We should note that Canada reduced its burden in a time of global prosperity when demands for Canadian commodities increased. Historically, however, only one developed nation was able to repay its debt after crossing the 110% Debt/GDP mark; the United Kingdom after WWII.

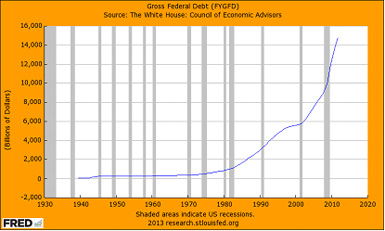

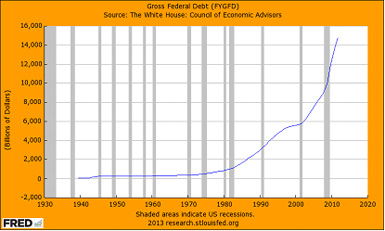

What about America? During each seminar I give, people always mention the size of US debt and most predict the collapse of the dollar and a future default of Uncle Sam. The United States situation is not as bad as many think, the debt ratio remains manageable and is much lower than the one observed in most European countries. As a matter of fact the US has a lower Debt/GDP then Canada, the economic darling of the G20. The United States also presents a lower tax rate. Obviously there is room to address the situation. The problem with the USA is the speed at which the debt is growing. The orgies of spending observed during the last 12 years are unprecedented. The cancer is curable but is spreading rapidly. (Fig 2)

Fig 2: Gross Federal Debt, source: Federal Reserve Bank of St-Louis

Even if we all know that the situation can't continue forever, history tells us that it can last for much longer than it should. We only have to look at Japan to realize that there are no limits to the politic will of kicking the can down the road for the generation to come.

You may ask if all countries, from the richest to the poorest, have debts? Who do we owe this money to? We owe it to other countries, banks, pension funds, individuals, corporations but most of all, in the US, the money is owed to the Federal Reserve. Over the last four years Mr. Bernanke's group purchased the largest part of the bonds issued by the US government. This explains why the rates have remained so low when supply increased faster than the "normal" market demand. This brings the question as to who will be buying all these bonds when the Federal Reserve stops its quantitative easing policy? Can the Fed ever stop buying treasuries without bringing an important recession?

Looking forward we need to assess the different country risk for bonds and equity that will be caused by excessive debts. When the next recession comes many countries may not have the means to stimulate their economy with increased spending without seeing interest rates shoot up. What will Italy or Spain's rates be like when the situation gets worse, or if Germany refuses to continue to carry Europe? The next recession may rapidly turn into a depression...

What does this mean for your offshore investment portfolio?

- Sovereign debts now present a higher risk than in the past and should not be considered a safe haven anymore.

- Investors should expect increased numbers of defaults going forward, from both emerging and developed markets.

- Global Currency devaluation is just starting, as it is the easiest way out for countries with high debt levels to stimulate their GDP through exports.

- As central banks destroy the natural order of supply and demand, to increase liquidity in the system and keep interest rates low, we should expect inflation to emerge (more on this next week).

- There is an asymmetry of risk in Sovereign bonds where the possible losses are much higher than the possible gains. They should be underweight in all portfolios.

- The next recession may bring higher interest rates for countries with high debt level. Investors should favor countries with low debt ratio as they will be better positioned to support their economies.

Next time: Monetary Policy Bastard's child, Inflation.

Eric St-Cyr

Chief Executive Officer

Clover Asset Management Limited

Cayman Islands

Email: forwardthinking@Clover.ky

Web: www.Clover.ky

|

| RBC - US Financials Income Note |

|

Investment Description Investment Description

An investment providing fixed levels of income of 10% over a 1 year horizon, and linked to the performance of US Financial Stocks. Regular income payments, made on a quarterly basis (2.50%) regardless of equity market conditions. Capital buffer: no loss of capital as long as no Stock has fallen below 50% of its initial level when observed on the Final Valuation Date (European barrier)

NOTE: closing March 11, 2013

Issuer: Royal Bank of Canada, one of the highest rated financial institutions in the world (AA- rated)

- Fixed Income of 10% pa

- 2.5% Fixed Paid Quarterly

- Short 12 Month Term

- Linked to a Select Basket of US Financial Giants

- High 50% Capital Protection European Barrier

Underlyings:('Stocks')

- Bank of America (BAC UN),

- Genworth (GNW UN),

- Morgan Stanley (MS UN),

- MBIA INC (MBI UN)

- Radian Group (RDN UN)

Fixed Income Payment Dates

- 1st Coupon Payment 2.5% paid on the 18th of June 2013

- 2nd Coupon Payment 2.5% paid on the 18th of September 2013

- 3rd Coupon Payment 2.5% paid on the 18th of December 2013

- 4th Coupon Payment 2.5% paid on 18th of March 2014 (Redemption Date)

Capital Protection:

100% Capital returned in 12 months as long as none of the underlyings are down more than -50% on the very last day (European Barrier)

ISIN Codes

- GBP: XS0891355918

- USD: XS0891355751

- EUR: XS0891356056

The Notes are available in USD, EUR and GBP

Risk Disclaimer: Please bear in mind that investors are exposed to the credit risk of the Issuer. The Notes are not capital protected and investors may receive back less than the original amount invested. The value of the investment can go down as well as up and investors can potentially lose all of their investment. Any secondary market provided by Royal Bank of Canada is subject to change and may be stopped without notice and investors may therefore be unable to sell or redeem

the Notes until their maturity. If the Notes are redeemed early they may be redeemed at a level less than the amount originally invested.

Royal Bank of Canada - US Financials Income Note brochure, available upon request.

|

| Luxury Pousada For Sale In Buzios

|

Buzios - Rio de Janeiro - Brazil - $859,000

14 apartments (of which 9 w / beautiful view and 5 w / partial view).

All apartments with balcony, air conditioning, minibar, TV and safe.

To see more photos and information click here.

Request more information about Brazil properties.

|

| Offshore Gold Storage |

|

You can store your metals with:

- VIA MAT - in vaults in Hong Kong, Switzerland and the UK.

- Brink's - in vaults in Toronto and Singapore.

- Rhenus - in a vault at Zurich Airport in Switzerland.

- G4S - in a vault in Hong Kong.

Ready to invest offshore in precious metals? click here

| |

|

Investment Description

Investment Description

Home Page

Home Page