| February 15, 2013 |

| Offshore Investment Guide |

|

Hi ,

Hope this message finds you well. Remember, I'm at your service to help you learn more about how to invest offshore.

We provide information about legal, tax compliant, asset protection strategies, for people from all over the world.

Aaron A Day

Tax Haven U.S.A.

The term "financialization" describes two interlocking processes: a disproportionate growth in a country's deregulated financial sector, relative to the rest of the economy, and the rising importance of financial activities with a focus on financial returns among industrial and other non-financial corporations, often at the expense of real innovation and productivity.

Some see the rising influence of finance and financial models in epochal terms. Author of Financialization and the U.S. Economy Özgür Orhangazi summarizes academic literature that sees financialization "as one of the indicators of the decline of the hegemonic power": imperial Venice, Genoa, Holland, and Britain all saw their power rise on the back of productive industrial capitalism, followed by domination by the financial sector, which eventually began to cannibalize the productive sector in pursuit of financial returns--a process that ended in weakness and collapse.

Little noticed in the academic discussions of financialization is the role of offshore tax havens, one of the big reasons the financial sector has become so powerful. In 1966, Michael Hudson, a young Chase Manhattan balance-of-payments economist, was in a company elevator when he was handed a memo by a former State Department operative. The memo came from the U.S. government, and Hudson was tasked with figuring out how much foreign money the U.S. might attract. "They were saying, 'We want to replace Switzerland,' " Hudson explains. "All this money will come here if we make this the criminal center of the world. We wanted foreign criminal money, which was patriotic, but not American criminal money."

Source: Vanity Fair - Where the money lives.

|

| Onshore Offshore Investment Experts |

| Did your Attorney/Tax Advisor tell you; move your IRA Offshore?

Did someone advise you to move your IRA Offshore? How do they know, have they been there, done that?

For exactly what type of investment account does your advisor speak?

This New York Attorney specializes in Self Directed IRA's and IRA LLC'sand told us that there are virtually no restrictions,

including geographical ones, on what a Self-Directed IRA can invest in other than the list of things the IRS tells you that

are prohibited investments....and, he says,

Therefore, a Self-Directed or IRA LLC can access fund investments globally that are not registered with the S.E.C...

He might think that since and for sure all European Financial Institutions are now, or will be, FATCA compliant that it would mean

they would be willing to accept a U.S. person applicant, because the Institution will be reporting to the IRS all U.S. person and

U.S. person beneficiary accounts so what is the "big deal" opening a USA person account?

OK, so why don't you look before you leap. Go Offshore and ask for an investment fund or an investment account.

What has actually happened is that a U.S. person can not open a bank, brokerage or investment account in Europe and if he

currently has one they are asking him to close their account.

"Catch 22", as even the USA person living in Europe can not obtain a European Financial Account and he can not obtain a U.S. Financial

Account either. Just call any overseas reputable, regulated, registered,and recognized Financial Institution , for example, in London

or Luxembourg and tell them you are a U.S. person and want to open an account. They will hang up on you!

Now, there are some Foreign Financial Institutions Overseas who are registering as an S.E.C. Broker/Dealer but those defeat the global

investing purpose of an International thinking person who wants an International Investment Account with access to non-S.E.C. funds

because from i.e. a London, Luxembourg or Switzerland based S.E.C.Broker/Dealer you are able to obtain the same investment fund choice

that you receive from behind the walls (so to speak) of the U.S.A.. There is a difference between buying USA funds which invest

offshore and buying any of the worlds funds FROM offshore.

If you make an inquiry to an outside the USA financial advisor, brokerage, bank, investment fund or other financial institution and

your application is to be submitted along with a copy of your passport and proof of residence then for sure you know that they

are not offering you the FROM outside the USA nominee investment account that we have been explaining for months in this newsletter.

So, call us to learn what we know from having "been there and done that"!

|

| The Gold, the Bad and the Ugly. |

"A mask of gold hides all deformities."

Thomas Dekker

More than one year ago, I published an first column on Marketwatch.com named Dead Yen Walking. In that column, I advocated what I believed to be the best investment opportunity for the next few years. I recommended to go long USDJPY (long $US vs. the Yen), long CADJPY (long $Canadian vs. the Yen) and long XAUJPY (long Gold vs. the Yen).

The foundation for my recommendations was simple; the Japanese economy is a basket case. Japan's debt to GDP is rapidly approaching 230% (by far the worst in the world), their trade surplus is morphing into a trade deficit and their population is aging as well as shrinking. It is simply impossible for Japan to repay its debts. The only way forward is to continually print Yen until the country enters into hyperinflation and implodes. The most difficult part of the recommendation was the timing of it...when will it start? I can now say with strong conviction that it started with the recent election of Prime Minister Shinzo Abe to the head of the country. His politics of growth, higher inflation and lower currency value are exactly what the doctor executioner ordered.

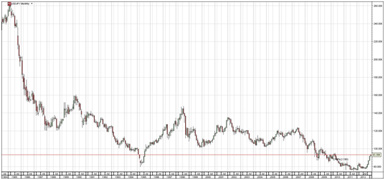

Since January 2012, the USDJPY (number of Yen to the $US) moved from 76 to 93, a return of 22% in 13 months. Technical analysts and market timers are now saying that the trade is overdone and that we are due for a major pullback. I understand why they feel this way; nothing can go up in a straight line eternally. The daily chart clearly indicates that we should expect a correction soon. (Fig 1)

I do not deny the fact that the trade should be taking a breather at this point. However, looking only at a daily chart for the last 13 months is missing the greater picture we get by looking at the historical data since 1985 (Fig 2):

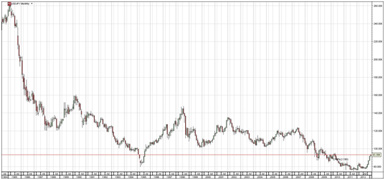

Figure 2: We are just started

In 1985 the USDJPY was over 260. The recent rise in USDJPY is nothing in comparison to the drop over the last thirty years. The only reason we can see that may stop the Yen from returning to its previous value is a deterioration of the US economy so severe that it would challenge the collapse of the Japanese economy. We don't forecast such a scenario. The debt situation in the USA is bad, and is getting worse. Also, the lack of leadership in Washington is worrisome. However, the USA is not Japan. The United States has: a growing population, an open mind toward immigration, the global reserve currency and remains the economic and military world leader. These are all aces up Uncle Sam's sleeve that should help avoid a catastrophe. Therefore, this trade should continue to do well in the months and years to come.

Are there better trades out there?

Even if you believe in the coming collapse of the Japanese economy, you need to remember that a currency trade is made of a pair of currencies; in this case the $US and the Japanese Yen. If, like me, you strongly expect the Yen to collapse in the coming years, you should then focus your attention to the other component of the pair, the $US. Is the $US dollar the strongest asset to pair against the Yen going forward?

Today's reality is that the four largest global developed markets (Europe, USA, Japan, UK) are all trying to stimulate their economy by reducing the value of their currencies. By doing this, those economic powers look at increasing their exports and creating inflation.

Is there better currency out there? Certainly, the Canadian Dollar or the Australian Dollar comes to mind. They represent much stronger economies and their printing press was stopped a long time ago. However, those two economies also present high volatility due to their dependence toward the commodity market. If the world enters into a recession, the price of commodities will drop, bringing the value of the $CAD and the $AUD with it.

What about Gold?

As a disclaimer, I should first say that I am not a gold bug. When looking at the intrinsic value of the asset, I would by far prefer to own a $1000 in oil instead of $1000 in gold. However, I believe that gold shouldn't be seen as an asset but more as a currency. The reality is that gold, contrarily to silver and platinum, has little industrial value. Gold takes its value from history, where for countless years it was considered a currency. People own gold as insurance, as a hedge, not as a working asset.

If you own gold, consciously or not, you are bearish $US dollar. Owning gold is being long GOLD and short $US. Let me explain: When you bought your gold, either physical or through an ETF, you gave Dollars in exchange for it. Therefore, you bought Gold (XAU) and sold Dollar (USD). In currency terms, we call that trade being long XAUUSD.

Now ask yourself, which currency out there will be the worst in the coming years? The Euro? The Sterling? The USD? Or the Yen? All of those currencies are bad, but one is truly ugly. The trade to enter in the coming years is long XAUJPY (buy gold sell Yen). This trade removes the uncertainty of the $US and leaves us with the best currency pledged against the worst. This is the perfect formula for a home run.

If you already own gold there are still a ways to execute this trade. For more information on this trade, and other ways Clover Asset Management can help grow your wealth please contact us at forwardthinking@clover.ky.

"The desire of gold is not for gold. It is for the means of freedom and benefit."

~ Ralph Waldo Emerson

Eric St-Cyr

Chief Executive Officer

Clover Asset Management Limited

Cayman Islands

Off: 345-947-0005

Cell: 345-926-0005

Email: forwardthinking@Clover.ky

Web: www.Clover.ky

|

| East to West Autocallable Notes 5 |

|

Key Features

Investment linked to the benchmark indices of the UK, US, China and Taiwan, providing the opportunity for semi-annual returns of 5.0% (10.0% per annum), and 9 opportunities for early redemption over a 5 year investment term.

Investment Description

- A 5 year investment linked to the performance of the benchmark indices of the UK, US, China and Taiwan

- The Notes will "Autocall‟ triggering an Automatic Redemption if on any semi-annual Observation Date all the Underlying Assets are greater than or equal to their Initial Valuation Level

- In the case of Automatic Redemption the Notes return 100% of capital invested and the investor shall receive 5.0% for each semi-annual period the Notes have been active i.e. if the Notes are automatically redeemed at the end of year 3, the investor will receive a Coupon Amount of 5.0% x 6 plus 100% of initial capital

- Capital is at risk with this product: A fall of 50% or more in Performance is required in any Underlying Asset before capital is at risk. The Performance is measured by comparing the Initial Valuation Level to the Final Valuation Level on the Final Valuation Date. If any Performance measures a fall of 50% or more investors will receive the Performance of the Worst Performing Asset at maturity

NOTE: closing Feb. 21, 2013

Issuer: Nomura Bank International plc (NBI), rated as A- by S&P

- The Nomura East to West Autocallable Notes 5 ("the Notes") are linked to the benchmark indices of the UK, US, China and Taiwan

- The Notes provide investors with the potential for returns of 5.0% for each semi-annual period over the life of the investment, combined with 9 opportunities for early redemption

- The Notes are issued by Nomura Bank International plc ("the Issuer"), which is rated by S&P as A-, at the time of a publication

- The Notes are issued in GBP, USD, and EUR, have an investment term of 5 years, and are intended to be held for the entire period

Underlyings:('Stocks')

- FTSE 100 Index (UKX Index)

- S&P 500 Index (SPX Index)

- Hang Seng China Enterprises Index (HSCEI Index)

- MSCI Taiwan Index (TAMSCI Index)

ISIN Codes

- USD - XS0875790346

- EUR - XS0875789413

- GBP - XS0875788878

The Notes are available in USD, EUR and GBP

Risk Disclaimer: Please bear in mind that investors are exposed to the credit risk of the Issuer. The Notes are not capital protected and investors may receive back less than the original amount invested. The value of the investment can go down as well as up and investors can potentially lose all of their investment. Any secondary market provided by Nomura International plc is subject to change and may be stopped without notice and investors may therefore be unable to sell or redeem the Notes until their maturity. If the Notes are redeemed early they may be redeemed at a level less than the amount originally invested.

Royal Bank of Canada - Gold Miners Phoenix Notes brochure, available upon request.

|

| Brazil Beach Frontage Resort Property |

Beachfront Development Property - Zoned for Hotel or Gated Community - $3,300,000 USD

Location: São Miguel do Gostoso, Rio Grande do Norte.

Land located on the spectacular beach of São Miguel do Gostoso has 250 meters of beach frontage and a total of 141.815m2.

- 5 plots of 50 meters each of flat beautiful beach.

- The boundaries are the North Atlantic Ocean and the South, the road Sao Miguel do Gostoso / Reduto. (road to Tourinhos)

- Great for resorts, lodges, condos or beach houses.

- The deed of the land is registered in the Registry Office competent Real cartório Notarial de Touros, Rio Grande do Norte.

- We can also sell the land already approved for gated neighborhood or resort.

Request more information about Brazil properties.

|

| Offshore Gold Storage |

|

You can store your metals with:

- VIA MAT - in vaults in Hong Kong, Switzerland and the UK.

- Brink's - in vaults in Toronto and Singapore.

- Rhenus - in a vault at Zurich Airport in Switzerland.

- G4S - in a vault in Hong Kong.

Ready to invest offshore in precious metals? click here

| |

|

Home Page

Home Page