The Roth IRA is the better-looking (and smarter!) cousin of the traditional IRA. The Roth IRA came into existence in 1997 as part of the Taxpayer Relief Act. The provision was named for Senator William Roth of Delaware.

Over the course of years since its adoption into law, much discussion has followed regarding the merits of converting a traditional IRA into a Roth IRA. The Roth IRA is particularly attractive for taxpayers with large IRA and qualified retirement plan balances. Frequently, wealth taxpayers really don't need the money to live on and would prefer to defer taxation on investment earnings as long as they can.

This article is an introduction to how private placement life insurance (PPLI) can be used as an alternative to the Roth IRA. When we compare the attributes of PPLI to the Roth IRA, we will conclude that PPLI with some added "bells and whistles" is a superior alternative to the Roth IRA, hence earning the name the "Super Roth IRA¹".

The Tax Landscape

Qualified plan assets and IRAs are very heavily taxed. These deferred income assets are subject to both income and estate taxation. In general, the combination of the two levels of taxation can erode 70-80 percent of the account balance depending upon which state you live in.

With the presidential election four weeks away, none of us has a crystal ball when it comes to tax policy. Absent any changes following the election in the "lame duck" Congressional Session, the bus is ready to drive off of the cliff.

Less I remind you, the Bush tax cuts are due to expire at the end of 2012. The top marginal income tax rate jumps to 39.6 percent. The new Medicare tax adds another 3.8 percent on unearned income. The phase out of personal exemptions and itemized miscellaneous deductions has the effect of adding another two percent. State taxation which can add another 5-10 percent. Taxpayers will be at a combined marginal income tax rate of 52-57 percent.

At the same time, the estate and gift tax exemption equivalent drops from $5.125 million to $1 million per taxpayer. The top marginal estate tax bracket increases to 55 percent from 35 percent.

As Congress can't agree on anything, it seems unlikely that any last minute change will take place.

Roth IRA Basics

The Roth IRA allows for annual contributions of $5,000 ($6,000 if age 50 or older). A taxpayer that files jointly is able to contribute to a Roth IRA if the taxpayer's modified adjusted gross income (AGI) does not exceed $173,000. The contribution phases out between $173,000-183,000.

For a single taxpayer, contributions phase out between $110,000-$125,000. A taxpayer that is married and files separately is unable to make a contribution if modified AGI exceeds $10,000.

The calculation of modified AGI excludes the proceeds from an IRA rollover or qualified plan. This important distinction generally speaking makes it easier for a taxpayer to position himself to do a conversion from a traditional IRA to a Roth IRA.

The tax rules for traditional IRAs require a taxpayer to begin required minimum distributions by April 1 in the year following the year in which the taxpayer reaches 70 ½. The IRS imposes a 50 percent excise tax on the difference between the required minimum distribution amount and the amount actually withdrawn. The distributions are taxed as ordinary income rates. Distributions before age 59 ½ are subject to a 10 percent early withdrawal penalty. The account balance is included in the taxpayer's taxable estate.

The Roth IRA does not have required minimum distributions. Distributions are not subject to income taxation. However, the distribution must be a "qualified" distribution. Qualified distributions require five years of "seasoning" within the plan unless the taxpayer is at least age 59 ½.

Distributions before age 59 ½ are subject to the 10 percent early withdrawal penalty as well as normal tax treatment on the distribution (as if it were a traditional IRA). Exceptions to these rules exist for a distribution for a first-time home buyer; distribution to a disabled taxpayer, or a distribution to a beneficiary on account of the taxpayer's death.

The account balance is included in the taxpayer's taxable estate. At death, the remaining distribution of the account is subject to the same rules as the traditional IRA. A surviving spouse as the beneficiary of the Roth IRA can treat the Roth IRA as her own. Other beneficiaries must distribute the balance over their life expectancies.

The investment guidelines for a Roth IRA are similar to the restrictions for a traditional IRA. The policyholder can expand the investment guidelines through the use of a self-directed arrangement. The prohibited transaction guidelines applicable to the traditional IRA apply to the Roth IRA as well as the tax rules on unrelated business taxable income (UBTI)

In summary, the Roth IRA provides for tax-deferral and tax-free distributions without the requirement for minimum distributions during lifetime, but distributions over the lifetime of the beneficiary at death. The account balance is subject to estate taxation. Taxpayers are pretty limited on contribution levels as well as the amount of income they can have in order to qualify. Hence, many high net worth taxpayers will not qualify.

Authors Note: The above article was written by Gerry Nowotny, a tax and estate planning attorney with a JD and LL.M in estate planning from the University of Miami School of Law.

¹Super Roth IRA is a trademark of Reg Wilson of Epic Financial.

|

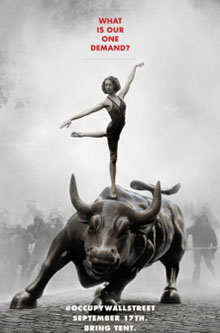

When Occupy Wall Street first began in September 2011, a large amount of media and movies was produced to define and explain the crimes of Wall Street (aka banksters) called the 1%. Prior to that time I'd already read Murray Rothbard's work ie. Wall Street, Banks, and American Foreign Policy (1995). Plus other books and reports from Austrian School Economists, as well as books such as Tragedy and Hope (1966) by Carroll Quigley, The creature from Jekyll Island (1994) by G. Edward Griffin, and None Dare Call It Conspiracy (1972) by Gary Allen. To mention just a few...

When Occupy Wall Street first began in September 2011, a large amount of media and movies was produced to define and explain the crimes of Wall Street (aka banksters) called the 1%. Prior to that time I'd already read Murray Rothbard's work ie. Wall Street, Banks, and American Foreign Policy (1995). Plus other books and reports from Austrian School Economists, as well as books such as Tragedy and Hope (1966) by Carroll Quigley, The creature from Jekyll Island (1994) by G. Edward Griffin, and None Dare Call It Conspiracy (1972) by Gary Allen. To mention just a few...

Home Page

Home Page