| September 9, 2012 |

| Offshore Investment Guide |

|

Hi ,

Many of the subscribers to this newsletter are legal and/or accounting experts from all parts of the globe. We have formed strategic alliances with several of the colleagues who have contacted us, and believe that in the field of asset protection and offshore investment, you can't have enough professional associates. So if there is something we can do for you, or some complicated tax related question you need an answer to, all you have to do is ask.

"How to use an IRA LLC to invest offshore"- is currently in production, let us know if you'd like to attend an upcoming webinar. Also, in the case of our strategic partners, we can private label these presentations with your company brand, to present to your contacts.

Let us show you why Luxembourg is the best place in the world, for asset protection, business development and offshore investment.

Aaron A Day

|

| Advantages of Offshore Mutual Funds |

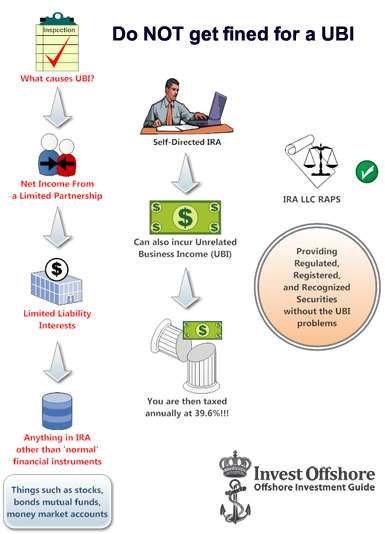

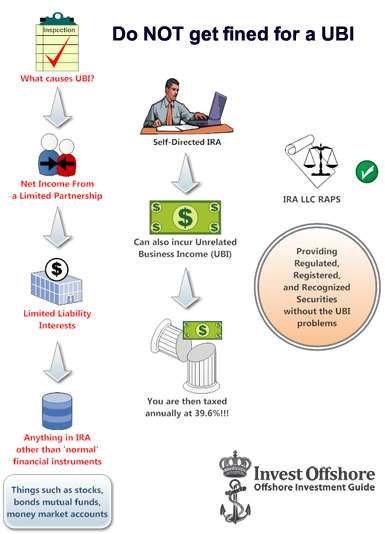

Regulator Asset Protection Structure (RAPS) IRA LLC provides you access to Offshore Mutual Funds without PFIC or FATCA issues.

Note: Charles Schwab Offshore Mutual Funds are not available to USA Persons

- Minimum or zero tax on capital gains, incomes, profits and dividends that accrue to the Fund. This would usually allow the Fund to outperform its peers domiciled in a high-tax jurisdiction, if only by the reason that the monies, which would otherwise be paid as tax, can in the case of an offshore mutual fund be further reinvested in the assets held by the Fund. While an offshore investment fund would typically operate in a tax-free environment and would therefore be able to grow faster, the individual investors should nevertheless remain aware of the fact that at the time when their investments are redeemed or when dividends are received from the offshore fund, such personal income may be subject to tax in their domicile country, at receipt. To this extent, qualified tax advice should be sought by the investor.

- Minimum or zero tax on fees, commission income and profits earned by the Fund Managers, Advisors and Administrators, registered and regulated in an offshore financial center. Again, this may provide a competitive advantage to these professionals, for instance, by giving them an opportunity to charge lesser fees and commissions than do their competitors, who happen to be located in high-tax jurisdictions.

- Greater operational flexibility, in terms of both the choice and structuring of the investment portfolio, and in relation to the internal structuring of the Fund itself. This largely owes to the fact that less "red tape" and formal regulation is generally allowed by mutual fund legislation in offshore financial centers, as compared to creation of mutual investment vehicles in most high-tax countries. Offshore investment funds have access to the widest possible variety of investment instruments and may often pursue more aggressive investment strategies than if they were registered in a "traditional" jurisdiction.

- The same relatively lower level of regulation allows for a faster and easier establishment process of an offshore investment fund. Subsequent running and administration costs are typically lower, too. Series of offshore investment funds, designed under the same pattern and having the same recognized managers and administrators, may be created extremely quickly and with minimum cost. As a result, an offshore investment fund can be offered to potential investors at more attractive financial terms. It is also quite common for an offshore investment fund to outsource some or all of its support functions to outside providers, either in the same jurisdiction or abroad. Thus, the fund administration, management, investment advisory and shareholder relations may be subcontracted to established service providers elsewhere. The recognition process of such outside providers for the purposes of licensing of the particular offshore investment fund is usually quite straightforward. Again, such flexibility and variety of choices quite simply ensures a more efficient and profitable running of the fund.

Our Structure gives you access to Regulated, Registered, Recognized Financial Markets without USA person restrictions nor FATCA withholding issues!

Free no-obligation consultation, available upon request.

|

| Gold Gains 5% in 5 Days |

Gold gained 2% Friday and nearly 5% in the previous 5 days. This lifts prices to 6 month highs. For now $1700 is eyed as support with $1670 under that level. Silver gained over 3% Friday with prices approaching $34/ounce also at 6 month highs. Support is seen just under $33 with next upside target of $35. High to low in 2012 copper completed a 50% Fibonacci retracement gaining over 20 cents last week. A strong correlation exists to the stock market currently so we don't think it will get much more.

Ready to invest offshore in precious metals? click here

Offshore Investment Platform

We can assist the most difficult USA Connected person with the Asset Protected and Tax Saving structures. This can also be accomplished for individuals of a number of different countries, taking into consideration their nationality and their country of residence. Allow us to introduce the most compelling reason for an offshore investment account - it's the genesis of Offshore Fund Platforms, Discounted Fund Platforms, Offshore Fund Supermarket and Online Investment Platforms.

This best-of-breed Offshore Investment Platform provides portfolio management software designed to give an investor the maximum choice of global financial instruments and the maximum flexibility. It's easy to set up, has competitive costs and is simple to run. The key to this offshore investment platform is that it allows an individual to invest for many purposes, in one plan, and provides online access to your portfolio with full confidentiality.

Free no-obligation consultation, available upon request.

|

| Brazil Country Club with Golf Course |

Building Lots for Sale in Gated Community - $39,000

Location: Maricá - Rio de Janeiro - Brazil - (25 miles North of Rio)

Request more information about building lots in the Gated Country Club with golf course in Maricá, Rio de Janeiro, Brazil

|

| Karatbars International - Gold Program |

|

The Karatbars group based in Germany, Belize and Thailand are bank-independent trading houses for merchandise and precious metals, especially Gold bullion in the form of a card in small denominations.

Karatbars International is an Internet trading company and its products are shipped worldwide to an expanding list of countries. They offer one of the most extraordinary range of products on the market. "Atasay Sanayi Ve Ticaret AS Kuyumculuk" of Turkey are the producer and supplier of the one-gram gold bars of the brand "ATAkulche".

Karatbars International is listed with the London Bullion Association Market (LBMA). Karatbars International is listed with the London Bullion Association Market (LBMA).

| |

|

Home Page

Home Page