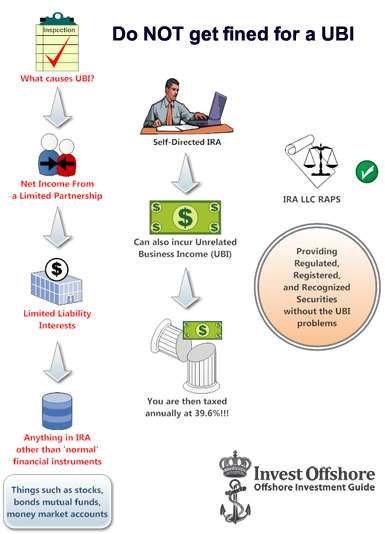

Why to use an IRA LLC Regulator Asset Protection Structure (RAPS)

This title is Advisor-speak which translates to: Does your self-directed (checkbook) IRA LLC have a "unrelated business income" (UBI). As innocuous as that question may sound, it's one of the biggest concerns we see related to offshore investment structures. As much as we continually pledge to not dwell on the negative news from the world of offshore investment, it's still important to remind our readers that we are aware that many people have been provided bad legal advice - from onshore, to sell things in the offshore, that ought not to have been bought.

Are you aware that the IRS has a special task force assigned to tracking down and penalizing those with offshore credit cards and offshore bank accounts? How about an international tax task force to help countries bolster their tax systems and fight financial crime? Inspecteurs des impôts sans frontières (Tax Inspectors Without Borders) is a new initiative aimed at transferring tax expertise to developing countries set up by the Organization of Economic Cooperation and Development. The witch hunt for tax revenue has gone "Hot" and this time it's global.

Self-Directed IRA's allow a lot of irresponsible self direction but beware if you have potential Unrelated Business Income you owe annually a 39.6% Tax! YES, your IRA LLC is subject to annual taxation if the IRS determines it is holding Unrelated Business Income!

It is not possible for the IRA LLC Regulator Asset Protection Structure (RAPS) to ever have a UBI problem!

The definition of UBI for this purpose is pretty broad. Think about that limited partnership that you are invested in. What is it really? It's a commercial venture. A for-profit activity. The net income that the partnership throws off to your IRA would be subject to the UBIT. It's business income unrelated to the operation of your IRA account.

And, not just partnerships can throw off UBI. UBI can also come from ownership of Limited Liability Company (LLC) interests. It can come from virtually any number of investments, such as rent and royalty income. In short, if you hold anything in your IRA other than "normal" financial instruments such as stocks, bonds, mutual funds, money market accounts, etc., it's very possible that your IRA will generate UBI. And, if that's the case, it's very possible that your IRA will be required to file a tax return and pay UBIT.

This article isn't intended to go through all of the details regarding UBIT. The intention is to let you know that this potential problem might exist in your IRA, depending on your investments and their earnings.

So What! Who cares about UBI?

The taxes that your IRA account is required to pay will reduce the balance in your IRA account, which will reduce your tax-deferred or tax-free income, that's what. And, it's a hassle. And, in addition to the tax, the IRA will likely have to pay tax preparation fees, compounding the problem. It is important, you really want to look at any business investments with an eagle eye before you actually invest with your IRA funds. You could be buying yourself a big problem... not to mention a big tax bill.

Consider some of the challenges. If your IRA is illiquid -- fully invested -- it might not have the cash to pay the tax. If you pay the tax out-of-pocket, it's treated as a contribution to your IRA account, which might lead to excess contributions if you've already made a contribution for the year. So, if you decide to pay the taxes, you better hope and pray that they don't amount to more than your allowable annual contribution. Anything greater would be an excess contribution.

Additionally, these types of business investments, non-registered securities, are generally very illiquid themselves. Once you get your hands on a partnership investment, you've got a firm grip on it for a long, long time. Partnership interests are nearly impossible to sell, so you have to ride out the partnership until it finally pays off or winds down. Many times, selling the business investment early will generate large losses... not something that you want in your IRA.

You might think that the IRA can simply sell the business interest to you personally... at an inflated price. Think again. That's a prohibited transaction, regardless of whether the sales price is inflated or not. If you engage in a prohibited transaction in your IRA account, the entire IRA is deemed to have been closed and distributed to you. Can you say, "Big taxes and early distribution penalties?" I knew that you could.

Finally, some of you might be scoffing, "I've had business income in my IRA for years, and I've never filed a tax return or paid any tax on the income." Well, that's great for you, at least for the time being. It's clear that the IRS hasn't looked into this issue in the past, so you might have just been lucky, but the law is the law, and the "no cop, no stop" method of tax planning is one that can buy you a ton of trouble.

I personally believe that, as IRA accounts get larger and larger, the IRS might begin some studies on this very issue, and will find it an area that might generate substantial tax dollars, which means more audits. I'm sure you would hate to be blind-sided by an IRS auditor on this issue, wouldn't you? Speaking of audits, you might be secretly smiling to yourself and thinking, "Well, since I've never been caught in the past, the statute of limitations has already expired on most of my prior-year indiscretions." Well, wipe that smile off your face and think about this: Generally the statute of limitations only begins to run when an appropriate tax return is filed. If no return is filed, the statute of limitations countdown never begins, and if it never begins, it can never end. In effect, there is no statute of limitations protection for a non-filed return. Yikes!

So, if you have these issues, you really need to deal with them. If you don't have these issues, I hope that I've provided enough information and food for thought to allow you to closely inspect your IRA investments and stay with regulated. registered, recognized securities that are available in the IRA LLC RAPS!

Our Structure gives you access to Regulated, Registered, Recognized Financial Markets without USA person restrictions nor FATCA withholding issues!

Free no-obligation consultation, available upon request.

|

Home Page

Home Page