Why Luxembourg for Investor Protection

Correspondence with an asset protection professional.

Hi Invest Offshore, My clients, and those from my law firm, are looking to get out of the U.S. and as far away from the U.S. as they can. The best solution for them is to use a foreign corp for foreign investments and a U.S. LLC for U.S. investments. Nearly 100% of the law practice clients select the offshore LLC option. Of course, they realize they need to file certain forms with the offshore company, but they are free and clear of the U.S. if the shift hits the fan. Regards Asset Protection Attorney,

Dear Asset Protection Attorney,

Perhaps you would explain to me then:

- Why you use a Nevis LLC? (seems like an IRS red flag to me)

- How to make sure your clients avoid a Section 4975 problem?

- And your client's other how to "invest offshore" problems?

Our structure elicits none of these questions as an issue.

Sincerely,

Advisor

Side Notes

An attorney who is not thinking about what the person is restricted to for investment choice with his Nevis Corporation....his choice is all that high risk junk that ends up disappearing off the face of the earth and there is no police to prosecute those offshore scam artists...Yes, it sounds like I am marketing fear but in fact fear is real in the uncontrolled, not regulated, not recognized offshore registered stuff...you can register anything in Granada and when you collect enough money you can run off with it and no police will accept the problem as being in their jurisdiction....you see you were a bad boy and went offshore, away from your home country and now they are happy that you lost all of your money!

We are talking peoples retirement savings, not some 300 millionaire who plays the casino! This is all the money they have and they are going to dump it into crap with no investor protection...why have these people never heard of Luxembourg, because the scam artists don't need a license and they are the promoters to USA persons offshore!

He is an Attorney ...whoops they didn't teach him about investments in law school! People would be better off going to a heart specialist!

Response to the Asset Protection Attorney:

That USA person's want assets outside of the USA is exactly what we do in cooperation with Your Work.

Well, the point is that Regulated, Registered, Recognized funds/Asset Managers/trading platforms/securities dealers (those not registered with the S.E.C., AND if they want to get out of the USA then they better not be using a S.E.C. registered broker or dealer!) will not sell investments to a USA person or an LLC,Trust, IBC or other attorney created structure that has USA person beneficiary. Do a google on the best offshore hedge fund, or other funds or regulated financial structures offshore and you will read that no USA connected persons are allowed. I am not talking about something registered outside of the worlds largest 24 Financial Securities Exchange.

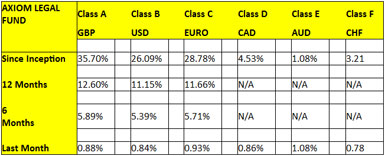

Our Clients want the best and the best also have strong regulatory investor protection. For Example, the 2nd largest number of funds are registered in Luxembourg and not one of those funds will accept a USA person or LLC or Trust with a USA beneficiary. Which means your client can go offshore with his Foreign Corporation, impress his friends at a cocktail party, but end up buying gold, and other non-securities.

With RESTRICTED investment choice your clients must accept huge risk which is not suitable for their Retirement Funds? I know they are mad at the USA but they will become more mad when their high risk investment turns into dust and they have no recourse. Meaning that your foreign corporation owner can not access any of the best offshore money managers....do a google, read the prospectus.

Our Structure gives your clients access to Regulated , Registered, Recognized Financial Markets without USA person restrictions nor FATCA withholding issues!

Free no-obligation consultation, available upon request. |

Home Page

Home Page