| November 9, 2012 |

| Offshore Investment Guide |

|

Hi ,

Over the past 50 issues we've progressed, by listening to readers of this newsletter and answering questions, one at a time. It's been a privilege to correspond with so many intelligent and interesting people. The purpose of discourse remains; how best to invest offshore.

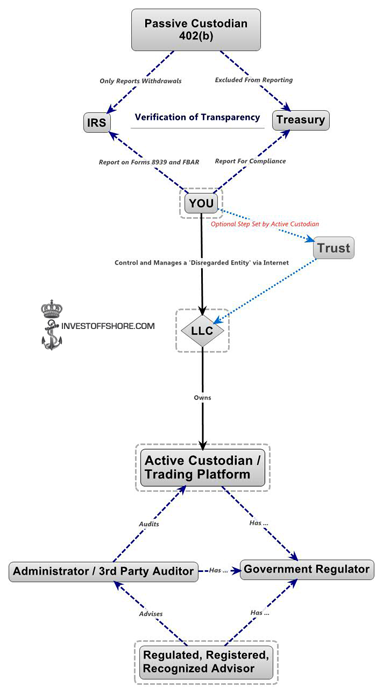

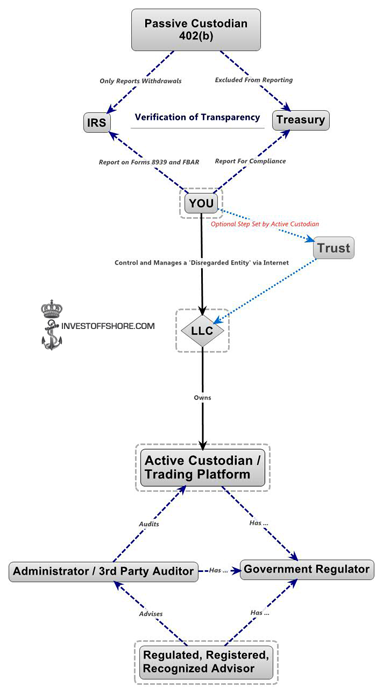

We know now, beyond a shadow of doubt, that the RAPS (regulator asset protection structure) is an ideal offshore investment structure for most people. The current legal-environment for Tax Havens and IFC's has changed the keyword from "privacy" to "transparency". Offshore investing and offshore banking will always exists, however in this new era, there can no-longer be secrecy or tax avoidance structures.

Offshore Asset Protection in contemporary culture, is thought of by the financially savvy, as sensible portfolio Geo-Diversification. For U.S. and most G-20 Nations a FATCA compliant (transparent) offshore investment account, has become the best way to invest offshore.

Gold, Diamonds, Real Estate, Art & Collectibles is another matter. You do NOT need an offshore investment account to own overseas assets but you should have a good offshore asset protection structure to manage these assets for you and your dependents. RAPS is a self-directed, do-it-yourself offshore investment account management system. Totally transparent and completely regulated, to the highest standards of every government anywhere.

Ultimately, it's the sheer simplicity of the RAPS structure, that makes it so easy to use. A paradigm shift has happened, and a quantum leap was taken. To bring offshore banking and offshore investment, out of the dark and into the light of transparency. There has never before been a better time to follow the exact tax code of your government, to set-up an offshore investment account, under the guidelines set-forth.

The green light is now lit! To invest offshore.

Aaron A Day

about.me/aaronday

|

| How to Invest Offshore |

| Do you know Financial Institutions?

There are only 3 types of financial institutions

- Bank

- Insurance Company

- Government Regulated Asset Protection Structure

The following are not Financial Institutions as they are only intermediaries

- Brokerage

- Trusts

- Attorney

- LLC, IBC, Foundation

- Trading Platform

- Financial Advisors

We don't recommend either a Bank or an Insurance Company. So, let's talk about the Financial Institution that you don't know; the Requlated, Recognized Registered Asset Protection Financial Institution we abbreviate as our "trade mark" the 'RAPS"!

NOTE: WE DO NOT PROVIDE TAX ADVICE TO INDIVIDUALS. WE PROVIDE IRS CODE AND IRS RULING SOURCE DOCUMENTS TO CERTIFIED TAX CONSUTANTS AND TAX ATTORNEY'S WHO HAVE SIGNED A NON-DISCLOSURE AGREEMENT.

TAKE ACTION! U.S. Persons who are ready to set-up an IRA LLC contact us today for a free no-obligation consultation.

|

| Totally Transparent, Totally Tax Compliant - Offshore Investment |

|

All Solutions are Specified in IRC Code which means that the IRS knows what it is and why it is.

All packages are located offshore and allow global investing FROM Offshore by means of a nominee account. It is the type of nominee that causes this account to be excluded from FATCA and therefore clients can access investments globally without U.S. Person restrictions or withholding/FATCA issues.

SOLUTION ONE: 1 million or more (accepts in kind assets)

- a) IRC Code Specified : No PFIC, FBAR or IRS Form 8938 reporting requirements.

- b) Customized investment account/brokerage/trading platform/discretionary manager/advisory only bankable and non-bakable assets

- c) tax deferral on investment income

- d) withdrawals tax advantaged

- e) avoids estate tax

- f) nominee account does not trade/deal as a U.S. Person and therefore no FATCA withholding issues.

- g) Your Account has a Government Regulated Fiduciary

- h) No S.E.C. investment restrictions or limitations

- i) Investment Bank 150 year history, segregated account with New York Mellon

- j) 100% Segragated Account. No 3rd Party Banking Risk. No FDIC Risk.

- k) no accredited investor restrictions

- l) You are provided a 3rd party audit annually.

- m) Transparent charging structure

- n) Assets Protected by Governance from U.S. Government. Creditors can not access any assets ever.

SOLUTION TWO: 250,000 or more (cash only)

- a) IRC Code Specified : No PFIC, FBAR or IRS Form 8938 reporting requirements.

- b) Customized investment account/brokerage/trading platform/discretionary manager/advisory only bankable assets

- c) tax deferral on investment income

- d) withdrawals tax advantaged

- e) avoids estate tax

- f) nominee account does not trade/deal as a U.S. Person and therefore no FATCA withholding issues.

- g) Your Account has a Government Regulated Fiduciary

- h) No S.E.C. investment restrictions or limitations

- i) Investment Bank 150 year history, segregated account with New York Mellon

- j) 100% Segregated Account. No 3rd Party Banking Risk. No FDIC Risk.

- k) no accredited investor restrictions

- l) You are provided a 3rd party audit annually.

- m) Transparent charging structure

- n) Assets Protected by Governance from U.S. Government. Creditors can not access any assets ever.

SOLUTION THREE: 50,000 or more (U.S. Resident Only)

- a) No PFIC, FBAR or IRS Form 8938 reporting requirements.

- b) Customized investment account/brokerage/trading platform/discretionary manager/advisory only bankable assets

- c) tax deferral on investment income

- d) No FATCA issues.

- e) Your Account has a Government Regulated Fiduciary in the USA and Overseas.

- f) nominee account does not trade/deal as a U.S. Person and therefore no Foreign Financial Institution withholding issues.

- g) Luxembourg Investment Account (24 Financial Markets any security with an ISIN)

- h) 100% Segregated Account. No 3rd Party Banking Risk. No FDIC Risk

- i) no accredited investor restrictions

- j) Transparent Charging Structure

- k) Assets Protected by Governance from U.S. Government. Creditors can not access any assets ever.

SOLUTION FOUR: 50,000 or more ( Non U.S. Resident Only)

- a) FBAR reporting but no IRS Form 8938 reporting requirements.

- b) Customized investment account/brokerage/trading platform/discretionary manager/advisory only bankable and non-bakable assets

- c) tax deferral on investment income

- d) withdrawals tax advantaged

- e) avoids estate tax

- f) nominee account does not trade/deal as a U.S. Person and therefore no Foreign Financial Institution withholding issues.

- g) Luxembourg Investment Account (24 Financial Markets: buy/sell any security with an ISIN)

- h) 100% Segregated Account. No 3rd Party Banking Risk. No FDIC Risk.

- i) no accredited investor restrictions

- j) Transparent Charging Structure

- k) Assets Protect by Governance from U.S. Government. Creditors can not access any assets ever.

SOLUTION FIVE: 6,000 USD initial and then any additional contributions at a minimum of 500 USD (When this account reaches 50,000 it is automatically moved up to the 50,000 or more account!

- a) No FBAR or IRS Form 8938 reporting requirements.

- b) Discretionary manager

- c) tax deferral on investment income

- d) withdrawals tax advantaged

- e) avoids estate tax

- f) nominee account does not trade/deal as a U.S. Person and therefore no FATCA withholding

- g) 100% Segregated Account. No 3rd Party Banking Risk. No FDIC Risk.

- h) Competitive Charging Structure

- i) Assets Protected by Governance from U.S. Government. Creditors can not access any assets ever.

|

| RBC Capital Markets |

|

Introducing the 12 Month $ 8.8% pa US Consumer Recovery FIXED INCOME NOTE from Royal Bank of Canada (AA rated) Introducing the 12 Month $ 8.8% pa US Consumer Recovery FIXED INCOME NOTE from Royal Bank of Canada (AA rated)

- *Fixed Income of 8.8% pa $ / 8.21% pa £ / 8% pa (paid quarterly)

- *Short 12 Month Term

- *Linked to 4 Select US Consumer Stocks

- *High 50% Capital Protection European Barrier

Underlyings:

- Best Buy Co Inc. (BBY UN Equity) Consumer Electronics giant controlling 20% of US market. High expectation for growth in sales of Electronics goods as recovery gathers pace

- Abercrombie & Fitch Co (ANF UN Equity) one of the best known clothing brands in the world with further expansion planned

- Trip Advisor Inc. (TRIP UQ Equity) world's leading global review and travel booking company with over 32 million members

- Pulte Group Inc. (PHM UN Equity) largest US residential land developers, strong performance and outlook as the US housing market continues its recovery

Key Points:

- Fixed income payable quarterly, 4 payments on 7th March 13, 6th June 13, 6th Sept 13 & 9th Dec 13

- 100% Capital returned subject to -50% European Barrier

- Income & Capital backed by AA rated RBC, one of the strongest financial institutions in the world

- No Annual Mgt Charge

- Available in 3 currencies £ $

- Term 12 months

- Daily liquidity with Secondary Market

- Available through all International Life Companies, Private Banks, Stockbrokers & Platforms

- Minimum Investment 10,000 £ $

Subscription period: 1st of November - 1st of December 2012 or earlier if fully subscribed

ISIN codes:

- GBP: XS0846034147

- USD: XS0846034493

- EUR: XS0846033925

Please request a RBC Fact Sheet.

The issuer of these notes, Royal Bank of Canada are one of the highest rated investment banks globally, Aa1 Moody's, AA Fitch, AA- S&P (on positive outlook for an upgrade). There is no other 3rd party involved; the ability to repay the capital + proceeds lies entirely with RBC alone. This should give you great comfort as they are regarded as a Safe Haven, the No. 1 safest bank in the Americas & No. 8 in the world.

|

| Paraty, Rio de Janeiro, Brazil |

Brazil Oceanfront Property ~ $1.5M USD

Click image to see Gallery Click image to see Gallery

- Plot size 2500 square mts.

- Constructed area around 550 square mts.

- Ground floor:

- 01 suite with double bed and a double sofa bed;

- 01 bedroom with two bunks;

- 01 bathroom;

- TV room;

- dining room;

- living room;

- full kitchen and

- balconies overlooking the sea.

- Top:

- 02 complete suites;

- 01 mezzanine with double sofa bed.

- Outside area:

- pool overlooking the sea and the mountains;

- bar with refrigerator and desk;

- grill and oven with rustic coffee table:

- hot tub in the pool;

- steam room attached to the pool;

- shower, toilet;

- 01 dorm.

Request more information about Brazil real estate.

|

|

|

Introducing the 12 Month $ 8.8% pa US Consumer Recovery FIXED INCOME NOTE from Royal Bank of Canada (AA rated)

Introducing the 12 Month $ 8.8% pa US Consumer Recovery FIXED INCOME NOTE from Royal Bank of Canada (AA rated)

Home Page

Home Page