| Overview

Here are the obvious advantages of investing from offshore:

- Geo-diversification - here, your choices are not located between San Francisco and New York, you actually have a global menu in your hands

- Then there's outside located assets protected by Governance from the Government which makes it safe for you and minimizes your risk in growth

- Then there's offshore located regulatory fiduciary as a segregated account, not a 3 rd party banking risk for you

- And finally, annually, a 3 rd party audit is provided for you. So, when was the last time your bank or broker sent you one of those?

As you've seen before, the advantage of investing from Offshore is really about more choice and selection. However, here are more reasons why:

- U.S. Funds must distribute their realized gains each year even when you want a Buy and Hold only strategy.

- In comparison, offshore funds are a 100% roll-up of the price fund.

- Now the benefit is much more distinct when you see that 100% of your realized gains increase the price and therefore making the fund 'zero' in tax for capital gains, income, profits and dividends.

So wouldn't you, being a non-USA person and top fund manager want to move your fund offshore? I mean as a non-USA person, what you're seeing here is you're paying zero tax on your fees. And with this difference in choice, you actually have control over invested returns now.

Investment Funds only available from Offshore

So here's where I think that when you're thinking of choices, the menu is much more diverse with these 3 additional funds.

They have attracted over 23 trillion plus worldwide and can only be accessed from offshore. Note - these funds are not sold to a USA Account holder. Bottom line is unless you have an offshore account, you can't have any of these types of funds even if you wanted them!

And they are:

- UCITS Funds - The Financial Times reports these as beating out the U.S. Funds in Asia and Latin America because of investment flexibility and hedge fund type strategies

- AIFMD Funds - These have greater operational flexibility in terms of both choice and structuring and have 16 Trillion invested worldwide

- Then there are SIF funds which have over 3 Trillion invested worldwide. Wouldn't you also want to explore what they have available to you?

The good news is that when you're investing from offshore there are so much more options. And the thing is that it's always a good when you have more to consider.

So now that you know the benefits, here's another shocking fact:

Many may not realize this but with the IRA and 401(k), you are dependent upon a list of investment products which is basically a default menu that your custodian or employer has decided upon. This is really a matter of opinion based upon what would be most suitable for you. Now in the well-known 60 Minutes 401k Fallout broadcast , what was said about this list is that,

'Well, a lot of those funds are mediocre. They're not really the best choice.'

This takes us into another problem.

IRA LLC PROBLEM

When you take an IRA where an LLC is added to it, the LLC is promoted on the basis that it gives you a self-directed platform. Remember, if it's a foreign LLC or a domestic LLC, it probably won't make any difference because it's a qualified plan, but in this case, your 'checkbook IRA' so to speak is created.

What this does is allow you to write a check and purchase what you want. However, what happens is this can create problems for you, because the IRS has made a ruling with Number 4975 where what it says that if the IRS determines at any future time that you ARE the custodian of the IRA, then they'll disallow all the tax benefits.

This means you now suddenly have back taxes and penalties to pay! And what has started off as a good intention is now a seriously wrong choice with a huge loss to your retirement plan!

IRA LLC PROBLEM COMPOUNDED

The problem continues because with a self-directed IRA, you actually choose to have the risk of non-registered, non-regulated investments. So let's say your unemployed next door neighbor has a great idea and comes to you for a loan. You could make that loan to him under a self-directed IRA. Or you could purchase crop, livestock, commodities and a lot of things that are actually very risky if you're not knowledgeable about them.

More common examples include tax liens, stock rights and warrants. Again, these possibilities are carrying huge risks of loss. So I think in honesty, these are really not the best choices considering that this is retirement planning you're doing.

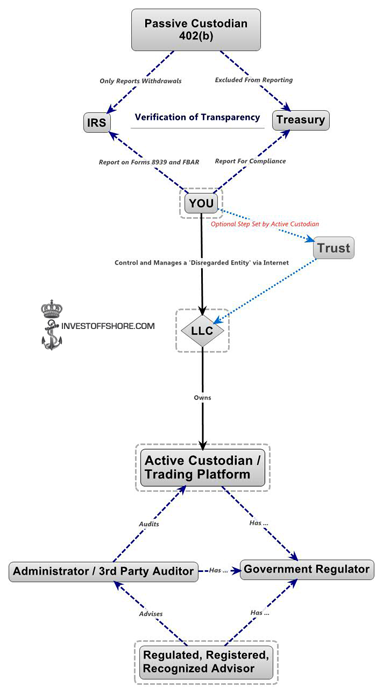

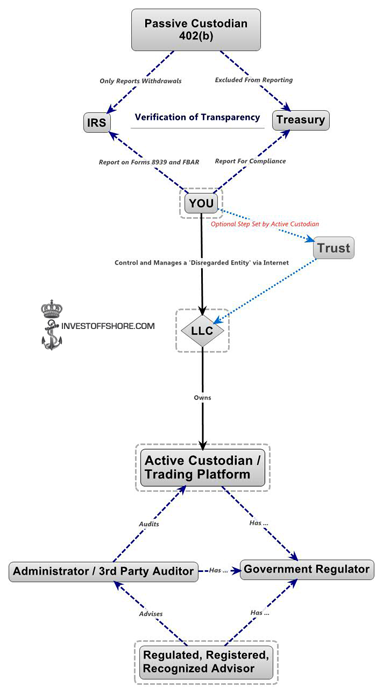

GOING OFFSHORE

Altogether, going offshore is really a matter of following a regulated structure. First, make sure that your custodian and your overseas active custodian is administered by a regulated, registered, and recognized foreign retirement plan. This makes your IRA and your domestic U.S. IRA custodian, whom we call the 'Passive Custodian reporting to the IRS' exempt by FATCA. As long as your offshore purchasing vehicle is regulated, registered and also recognized by a foreign retirement plan administrator, it will also be exempt from FATCA.

The reason is because a foreign retirement plan administrator is one of the 5 things exempt by FATCA already. So now if you wanted to self-direct your investments by means of an IRA LLC, especially to give you worldwide registered investment choices, the problem of FATCA is eliminated. The great thing about this structure is that the doors will now be open to you overseas, making it agreeable for the investment provider to do business with you.

IRA LLC. SET-UP PROCESS

Now I've just taken you through a structure which simplifies the work on your part, because long-term, what you're seeing is compliance and choices from a global scale as well as tax-deferred growth. Overall, with the IRA passive custodian in the USA and the offshore active custodian investment account in place, the IRC Section 4975 problem of the "Checkbook" IRA LLC is eliminated. So you're now managing the LLC but you're not acting as a custodian where the hidden side effects are seen. Also, when the tax deferred active custodian account is being reported on FBAR, you're excluded from reporting the IRS Form 8938 to the IRS. And what this does is make the account an IRA.

So basically, you'll find that the foreign retirement plan administrator is responsible for your U.S. tax compliance reporting now. This makes it easier for the offshore provider to work with you and receive your investment without too much filing work.

There are no USA person "offshore" restrictions, you get global fund choice. There's no PFIC issues and finally, no FATCA issues. As I said, here's the beginning of the structure which I just explained to you previously. It's called the IRA LLC Regulated Asset Protection Structure. Now how beautiful is that?

Once you and the reporting custodian reports, we then start the LLC which you can manage by logging into your account online. There's also an optional step here which you can take and that is to create a Trust which managed the LLC for you. From there, we then head on down towards governance.

With the LLC in place, set up by yourself or through a trust, in order for the investment platform to give you regulated and registered global choices, an advisor is required to help you administer and recognize your platform for governance.

So as you can see, with the structure laid out for you to help you regulate your assets and in turn protect it, your tax-deferred growths are safely guarded.

TAKE ACTION! U.S. Persons who are ready to set-up an IRA LLC contact us today for a free no-obligation consultation. |

Home Page

Home Page