|

A. AIFMD Funds: (16 Trillion is currently invested in AIFMD funds globally) are not available to non-accredited investor or USA person's, when Investing Offshore but they are ALL available when Investing FROM an Offshore Investment Account.

* definition of accredited investor is:

a natural person who has individual net worth, or joint net worth with the person's spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person;

a natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

B. UCITS: A growing number of investors are including hedge funds and other alternative strategies within their portfolios as a way of providing better portfolio diversification during adverse market conditions, as well as potentially boosting risk-adjusted returns over the long term. However, the recent financial crisis and a number of high profile fraud cases have highlighted challenges associated with the traditional hedge fund structure, particularly the lack of liquidity, transparency and effective regulation.

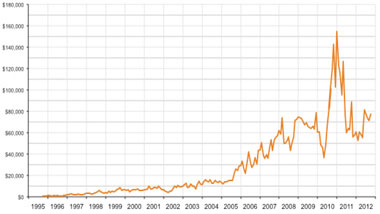

For retail investors, higher barriers to entry due to minimum investment size can also make gaining exposure to hedge funds difficult. As a result, investors are increasingly turning to regulated open-ended funds, such as those covered by the European Union's UCITS regulations, as a way to gain easier, more liquid, and more transparent exposure to alternative investment strategies.

C. SIF (Specialized Investment Funds): 3 Trillion invested worldwide - The Specialized Investment Fund (SIF) is a regulated, operationally flexible and fiscally efficient multipurpose investment fund regime for an international, institutional and qualified investor base. In comparison with institutional funds created under Part II of the Law of 20 December 2002 on undertakings for collective investment, the SIF is characterized by greater flexibility with regard to the investment policy, broadening of the sphere of investors and a more relaxed regulatory regime.

Tax regime

The SIF will benefit from the exemption from the payment of:

- income tax;

- capital gains tax;

- withholding tax

Contact us for a no-obligation consultation.

|

Home Page

Home Page