| January 22, 2012 |

| Offshore Investment News |

|

Dear ,

Researching and reporting, to help you identify the best practices for your own unique strategy to invest offshore. We consult with expert advisors who have professional indemnity insurance and provide complete accountability. These ideas are coming from people who have been working at protecting assets (offshore) for decades.

Our belief is that by sharing ideas and information, some readers will decide to pursue these recommendations, and work further with one of the professionals we introduce, other people will gather the information and continue planning for the future. In either case, we all learn more about offshore asset protection. Go-ahead and put us to the test.

Aaron A Day |

| Chinese Year of the Water Dragon |

|

The Dragon is one of the 12-year cycle of animals which appear in the Chinese zodiac related to the Chinese calendar, and the only animal that is legendary. The Year of the Dragon is associated with the earthly branch symbol The Dragon is one of the 12-year cycle of animals which appear in the Chinese zodiac related to the Chinese calendar, and the only animal that is legendary. The Year of the Dragon is associated with the earthly branch symbol

The symbol (see image) is of an ancient Chinese seal script form of the character for "dragon" that is pronounced lóng in Mandarin Chinese.

Water is the low point of the matter, or the matter's dying or hiding stage. Water is the fifth stage of Wu Xing.

Water is the most yin in character of the Five elements. Its motion is downward and inward and its energy is stillness and conserving. It is associated with the Winter, the North, the planet Mercury, the color black, cold weather, night, and the Black Tortoise (Xuan Wu) in Four Symbols.

Attributes

In Chinese Taoist thought, water is representative of intelligence and wisdom, flexibility, softness and pliancy; however, an over-abundance of the element is said to cause difficulty in choosing something and sticking to it. In the same way, Water can be fluid and weak, but can also wield great power when it floods and overwhelms the land. The negative emotion associated with water is fear/anxiety, while the positive emotion is calmness.

Astrology

In Chinese Astrology, water is included in the 10 heavenly stems (the five elements in their yin and yang forms), which combine with the 12 earthly branches (or Chinese signs of the zodiac), to form the 60 year cycle. The last time there was a Water Dragon was 1952. Water governs the Chinese zodiac signs Pig, Rat, and Ox. Water usually represents wealth and money luck in Feng Shui, although it might differ in some subjective scenarios. (note: listen to Raymond Lo)

Cycle of Wu Xing

In the regenerative cycle of the Wu Xing, metal engenders Water, as metal traps falling water from a source; Water begets Wood as "rain or dew makes plant life flourish".

In the conquest cycle, Water overcomes Fire, as "nothing will put out a fire as quickly as water"; Earth overcomes water as earth-built canals direct the flow, as well as soil absorbing water.

Raymond Lo, a feng shui master speaks in Hong Kong with Susan Li, to talk about the outlook for the Year of the Water Dragon.

Happy Chinese New Year! |

| FATCA Compliant Structures |

|

Mainstream media only reports negative news about offshore investment, such as the Governments pursuit of big Swiss Investment Banks, when in reality the amount of money lost to Ponzi schemes onshore, makes offshore pale in comparison. Offshore investing, generally speaking, is a much safer concept (than onshore) due to the added expense and complications involved in setting-up an investment fund offshore, the added scrutiny from the investor, and the all-seeing, ever-vigilant watchdogs. However, the offshore is a favorite choice of the sophisticated rip-off artist because (supposedly) it's easier to get-away with the money.

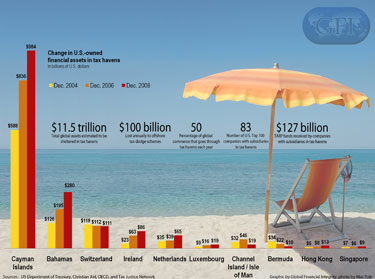

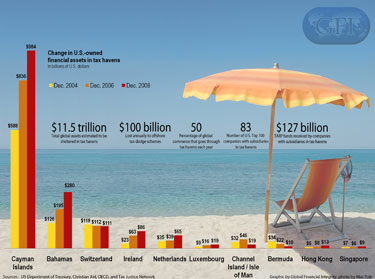

According to the accompanying graphic from GFI, called: U.S. Assets in Tax havens (see attached) from GFI, a hundred billion dollars is lost due to offshore scams.

Which brings up a thought: If the person has money offshore that he has not reported AND the Scam artist gets him to invest this money, then really who is the investor going to go to if this money is lost? This is why you should work with an adviser who has professional indemnity insurance. So that if the worst case-scenario were to happen with your offshore investment (ie. assets frozen or stolen), the onshore enforcement agency will just declare that the problem is not in their jurisdiction and the offshore government will declare that the victim is not in their jurisdiction of enforcement either...a real catch 22.

Therefore, there should be fear of sharks offshore, which is why working with an adviser registered, recognized, licensed in Luxembourg is the best idea ALSO

1. Maybe the unreported funds could be placed into a FACTA Compliant structure and then be legally non-reportable? That is a Question

2. After tax money could certainly be enclosed in a FACTA Compliant structure and therefore be non-reportable and provide access to global investments without restrictions.

Working with a professional offshore adviser can help you avoid FATCA Reporting requirements, achieve transparency, and avert withholding taxes:

- If you hold a foreign insurance company Life or Annuity Policy

- If you are a foreign financial institution dealing with U.S. connected persons or beneficiary's

- If you are a foreign Trustee with USA beneficiary's

- If you are an non-S.E.C. Registered asset manager

We can recommend US Compliant solutions that are achieved through direct coordination with tax and legal advisors, trustees, human resource managers, investment managers and family offices. We recognize the importance of a team approach to providing complex financial solutions.

Request an introduction to a Cross Borders Retirement Plan Consultant. |

RBC Gold & Silver Notes

13% PA Phoenix Quarterly Autocall |

|

Potential for annualized returns of 13% (3.25% per quarter), Early redemption every 3 months, Short 4 year term, 50% Protective European Barrier, Linked to the performance of Gold & Silver - a Safe Haven in these volatile times.

Underlyings:

- Market Vectors Gold Miners (GDX US Equity)

- SPDR Gold Trust (GLD US Equity)

- Global X Silver Miners ETF (SIL US Equity)

- IShares Silver Trust (SLV US Equity)

Given the recent sell off on these commodities, RBC struck the product on Jan 19th to maximise the chance of an early autocall.

Here are the strike levels:

- Market Vectors Gold Miners 54.31

- SPDR Gold Trust 159.65

- Global X Silver Miners ETF 22.55

- IShares Silver Trust 29.14

Key feature: Unique opportunity of positive returns when commodities rise AND fall

- Payoff 1: The product will pay a 3.25% coupon when underlyings are above 75% of the strike level on any 3 month anniversary i,e,. no more than -25% down & the product rolls on to the next 3 month anniversary date

- Payoff 2: The product will call & pay a coupon of 3.25% when underlyings are above the strike levels on any 3 month anniversary 16 opportunities of a pay out over 4 years, maximum payout of 52%

Capital Protection: 100% Capital returned at maturity as long as no underlying has dropped more than -50% on the last day only (European)

ISIN Codes:

GBP: XS0733089337

USD: XS0733089170

EUR: XS0733089253 Available: International Life Offices, Private Banks, Platforms & Stockbrokers. Subscription Period: 11th January - 24th January 2012 or earlier if fully subscribed.

The issuer of these notes is Royal Bank of Canada - one of the highest rated investment banks in the world, Aa1 Moody's, AA Fitch, AA- S&P. There is no other 3rd party involved, the ability to repay the capital + proceeds lies entirely with RBC alone. They have minimal Eurozone Sovereign Debt or banking exposure.

This should give you good comfort as they are regarded as a safe haven, No. 1 Safest Bank in the Americas & No. 8 in the world. The factsheet (available upon request), "Why RBC" runs through some off the key strengths of RBC and why they are so stable.

Request a brochure for the Royal Bank of Canada Gold & Silver Notes. |

| Build a dream beach-house in Brazil |

|

Do you want to economize AND own a new custom made beach villa with marvellous ocean views in Brazil? Here is a comprehensive new-build package for overseas investors. These are just some of the

advantages of building a brand new home in Brazil

- Can be cheaper than buying a re-sale home

- Built to your specifications, taste and budget

- It`s new! Cheaper option over the long term

- Significantly lower maintenance costs

- Higher rentability potential

- Better investment returns on re-sale

Common Objections to building a new home in Brazil

- How am I going to take care of the project as I can`t be in Natal to oversee the build and don`t know enough about construction

- I can`t speak Portuguese and construction companies are a headache to deal with.

- It`s too big a responsibility. All kind of things could go wrong.

Solutions:

You are in luck! Brazbeachhouse and thier construction partners can take all the pressure and stress off your shoulders throughout the entire planning and building phases. The project can be tailor-made to your design and budget.

The highly professional project team of Brazilian architect, engineer and project manager, all speak fluent English and have extensive experience building residential/commercial properties for international investors all over Brazil.

You make the decisions and dictate the price. BrazilBeachHouse take on all the responsibility and have contractual guarantees in place to ensure your new Brazilian property is delivered on time and on budget.

Here are the basic steps they follow to help build your brand-new Brazilian home;

1)Consultation on design,price

2)Design chosen, Project submitted for planning permission

3)Materials and fittings decided on

4)Itemized cost analysis of all materials used from the kitchen sink to the type of door knobs!

5)Construction work begins. Length of time for house completion can be between 4-6months depending on size of your project

6)Project completed. Keys delivered.Champagne uncorked!

Building Costs in Natal, Brazil (R$ = Reals)

STANDARD: cost for a high-quality build is R$1000 per m2 or

ECONOMY: If you would prefer to economize on the building materials the price can fall to R$750 per m2.

LUXURY: standard with the very best of fittings and finishings will cost you in the region of R$1500 per m2.

(click here for currency converter)

Request an introduction to Brazbeachhouse. |

| Truth and Lies Radio Show |

|

You are invited to join us for The Truth and Lies radio show, hosted by R David Finzer, the president and CEO of the Capital Conservator Group, on the Overseas Radio Network 1PM to 2PM New York Time Monday-Friday. This informative 1 hour radio show is dedicated to revealing the truth and exposing the lies about:

- international living and expatriation,

- pitfalls and rewards of the PT (permanent traveler) lifestyle,

- offshore companies, trusts, foundations and other structures, asset protection

Submit a question to be answered on "The Truth and Lies" radio show. | |

|

The Dragon is one of the 12-year cycle of animals which appear in the Chinese zodiac related to the Chinese calendar, and the only animal that is legendary. The Year of the Dragon is associated with the earthly branch symbol

The Dragon is one of the 12-year cycle of animals which appear in the Chinese zodiac related to the Chinese calendar, and the only animal that is legendary. The Year of the Dragon is associated with the earthly branch symbol